Difference between revisions of "Dow Jones Industrial Average"

VargasMilan (Talk | contribs) m (+ chart of recent prices) |

|||

| (29 intermediate revisions by 5 users not shown) | |||

| Line 1: | Line 1: | ||

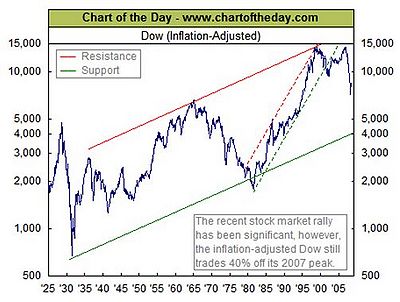

| − | The '''Dow Jones Industrial Average''', commonly known as the '''[[Dow Jones]]''', is a [[stock]] price index based on | + | The '''Dow Jones Industrial Average''', commonly known as the '''[[Dow Jones]]''' or simply the '''Dow''', is a [[stock]] price index based on 30 prominent publicly held [[stocks]] on the [[New York Stock Exchange]]. [[File:Dow1925-2009.jpg|400px|thumb|Dow Jones index since 1925, in constant 2009 dollars]] The DJIA can be traded under the stock symbol DIA. The other two major indexes are the "S&P500" (which can be traded under the symbol "SPY") and "NASDAQ" (the trading symbol "[[QQQ]]" somewhat tracks that index). |

| + | The strength of this basket of these 30 stocks as an investment tool is in the additional productivity of having multiple approaches to a challenge. Our [[Template:Mainpageleft|Mainpageleft]], with its collection of roughly 135 key entries, illustrates a similar approach to developing helpful insights. | ||

| − | The Dow Jones Industrial Average is the average of these thirty stocks, and is a commonly used indicator of general trends in the prices of [[stock | + | The Dow Jones Industrial Average is the average of these thirty stocks, and is a commonly used indicator of general trends in the prices of [[stock]]s and [[bond]]s in the [[United States]]. The Dow Jones Industrial Average was first published by ''[[Wall Street Journal]]'' editor Charles Dow in 1896 with twelve stocks. The only stock of the original twelve that is still a part of the Average is [[General Electric]]. |

| + | |||

| + | Unlike other indexes, the stocks in the Dow are weighted according to the price of one share of each company's stock, rather than by its market capitalization (overall company value). Thus the higher the stock price, the greater weight it has in the Dow. This tends to eliminate companies maintaining high prices for their shares, such as Amazon and Google, from being considered for inclusion in the Dow. The last time the Dow changed its component stocks was in March 2015, The last time the Dow changed its component stocks was in June 2018, when it replaced General Electric with Walgreens. The prior substitution was in March 2015 by the Dow, when it replaced AT&T (T) with Apple (AAPL). Due to the erosion of manufacturing jobs in the [[United States]] resultant from harmful [[free trade]] policies, the Dow is not really "industrial" any more. | ||

| + | |||

| + | As of June 2018 here are the 30 stocks in the "Dow" several of which are retail stocks or dependent on retail sales (e.g., AXP, CSCO, HD, KO, MCD, NKE, PG, V, WBA, and WMT): | ||

| + | |||

| + | *AXP - American Express Co | ||

| + | *AMGN - Amgen | ||

| + | *AAPL - Apple Inc | ||

| + | *BA - Boeing Co | ||

| + | *CAT - Caterpillar Inc | ||

| + | *CSCO - Cisco Systems Inc | ||

| + | *CVX - Chevron Corp | ||

| + | *DWDP - DowDuPont Inc | ||

| + | *GS - Goldman Sachs Group Inc | ||

| + | *HD - Home Depot Inc | ||

| + | *HON - Honeywell | ||

| + | *IBM - International Business Machines Corp | ||

| + | *INTC - Intel Corp | ||

| + | *JNJ - Johnson & Johnson | ||

| + | *KO - Coca-Cola Co | ||

| + | *JPM - JPMorgan Chase & Co | ||

| + | *MCD - McDonald's Corp | ||

| + | *MMM - 3M Co | ||

| + | *MRK - Merck & Co Inc | ||

| + | *MSFT - Microsoft Corp | ||

| + | *NKE - [[Nike Inc]] | ||

| + | *PG - Procter & Gamble Co | ||

| + | *CRM - Salesforce.com | ||

| + | *TRV - Travelers Companies Inc | ||

| + | *UNH - UnitedHealth Group Inc | ||

| + | *VZ - Verizon Communications Inc | ||

| + | *V - Visa Inc | ||

| + | *WBA - Walgreens Boots Alliance | ||

| + | *WMT - Wal-Mart Stores Inc | ||

| + | *DIS - Walt Disney Co | ||

{| class="wikitable" style="font-size:98%; margin:left;" | {| class="wikitable" style="font-size:98%; margin:left;" | ||

| − | |||

|+ | |+ | ||

|+ | |+ | ||

| Line 18: | Line 53: | ||

|align="right"|+802 | |align="right"|+802 | ||

|align="right"|+6.4% | |align="right"|+6.4% | ||

| − | |align="right"| | + | |align="right"|3.95% |

|- | |- | ||

!2008 | !2008 | ||

| Line 24: | Line 59: | ||

|align="right"|-4,488 | |align="right"|-4,488 | ||

|align="right"|-33.8% | |align="right"|-33.8% | ||

| − | |align="right"| | + | |align="right"|13.70% |

|- | |- | ||

!2009 | !2009 | ||

| Line 30: | Line 65: | ||

|align="right"|+1,652 | |align="right"|+1,652 | ||

|align="right"|+18.8% | |align="right"|+18.8% | ||

| − | |align="right"| | + | |align="right"|11.30% |

|- | |- | ||

!2010 | !2010 | ||

| Line 36: | Line 71: | ||

|align="right"|+1,149 | |align="right"|+1,149 | ||

|align="right"|+11.0% | |align="right"|+11.0% | ||

| − | |align="right"| | + | |align="right"|4.35% |

|- | |- | ||

!2011 | !2011 | ||

| Line 42: | Line 77: | ||

|align="right"|+640 | |align="right"|+640 | ||

|align="right"|+5.5% | |align="right"|+5.5% | ||

| − | |align="right"| | + | |align="right"|4.15% |

|- | |- | ||

!2012 | !2012 | ||

| Line 48: | Line 83: | ||

|align="right"|+887 | |align="right"|+887 | ||

|align="right"|+7.3% | |align="right"|+7.3% | ||

| − | |align="right"| | + | |align="right"|2.50% |

|- | |- | ||

!2013 | !2013 | ||

| Line 54: | Line 89: | ||

|align="right"|+3,473 | |align="right"|+3,473 | ||

|align="right"|+26.5% | |align="right"|+26.5% | ||

| − | |align="right"| | + | |align="right"|4.80% |

|- | |- | ||

!2014 | !2014 | ||

| Line 60: | Line 95: | ||

|align="right"|+1,246 | |align="right"|+1,246 | ||

|align="right"|+7.5% | |align="right"|+7.5% | ||

| − | |align="right"|3. | + | |align="right"|3.30% |

|- | |- | ||

!2015 | !2015 | ||

| Line 66: | Line 101: | ||

|align="right"|-398 | |align="right"|-398 | ||

|align="right"|-2.2% | |align="right"|-2.2% | ||

| − | |align="right"|3. | + | |align="right"|3.15% |

| + | |- | ||

| + | !2016 | ||

| + | |align="right"|19,763 | ||

| + | |align="right"|+2,338 | ||

| + | |align="right"|+13.4% | ||

| + | |align="right"| | ||

| + | |- | ||

| + | !2017 | ||

| + | |align="right"|24,719 | ||

| + | |align="right"|+4,957 | ||

| + | |align="right"|+25.1% | ||

| + | |align="right"| | ||

| + | |- | ||

| + | |} | ||

| + | |||

| + | {| class="wikitable" style="font-size:98%; margin:left;" | ||

| + | |+ | ||

| + | |+2008-2009 by quarter | ||

| + | !Quarter | ||

| + | !closing price | ||

| + | !change | ||

| + | !% change | ||

| + | !coeff. var<br>volatility | ||

| + | |- | ||

| + | |align="right"|2008 1st | ||

| + | |align="right"|12,263 | ||

| + | |align="right"|-1,002 | ||

| + | |align="right"|-7.6% | ||

| + | |align="right"|2.30% | ||

| + | |- | ||

| + | |align="right"|2nd | ||

| + | |align="right"|11,350 | ||

| + | |align="right"|-913 | ||

| + | |align="right"|-7.3% | ||

| + | |align="right"|3.40% | ||

| + | |- | ||

| + | |align="right"|3rd | ||

| + | |align="right"|10,851 | ||

| + | |align="right"|-499 | ||

| + | |align="right"|-4.4% | ||

| + | |align="right"|2.25% | ||

| + | |- | ||

| + | |align="right"|4th | ||

| + | |align="right"|8,776 | ||

| + | |align="right"|-2,074 | ||

| + | |align="right"|-19.1% | ||

| + | |align="right"|12.15% | ||

| + | |- | ||

| + | |align="right"|2009 1st | ||

| + | |align="right"|7,609 | ||

| + | |align="right"|-1,167 | ||

| + | |align="right"|-13.3% | ||

| + | |align="right"|8.05% | ||

| + | |- | ||

| + | |align="right"|2nd | ||

| + | |align="right"|8,447 | ||

| + | |align="right"|+838 | ||

| + | |align="right"|+11.0% | ||

| + | |align="right"|3.25% | ||

| + | |- | ||

| + | |align="right"|3rd | ||

| + | |align="right"|9,712 | ||

| + | |align="right"|+1,265 | ||

| + | |align="right"|+15.0% | ||

| + | |align="right"|5.30% | ||

| + | |- | ||

| + | |align="right"|4th | ||

| + | |align="right"|10,428 | ||

| + | |align="right"|+716 | ||

| + | |align="right"|+7.4% | ||

| + | |align="right"|2.90% | ||

|- | |- | ||

|} | |} | ||

==Sources== | ==Sources== | ||

| − | http://usinfo.state.gov/products/pubs/oecon/chap12.htm | + | * http://usinfo.state.gov/products/pubs/oecon/chap12.htm |

| + | |||

| + | ==See also== | ||

| + | *[https://money.cnn.com/data/markets/dow/ Recent performance of individual stocks in the DJIA] | ||

| + | *[https://www.wsj.com/graphics/djia-components-history/ The Ins and Outs of the Dow Jones Industrial Average]. ''The Wall Street Journal''. Retrieved January 25, 2017. | ||

| − | [[Category:Stock | + | [[Category:Stock Market]] |

Revision as of 04:32, April 24, 2022

The Dow Jones Industrial Average, commonly known as the Dow Jones or simply the Dow, is a stock price index based on 30 prominent publicly held stocks on the New York Stock Exchange. The DJIA can be traded under the stock symbol DIA. The other two major indexes are the "S&P500" (which can be traded under the symbol "SPY") and "NASDAQ" (the trading symbol "QQQ" somewhat tracks that index).The strength of this basket of these 30 stocks as an investment tool is in the additional productivity of having multiple approaches to a challenge. Our Mainpageleft, with its collection of roughly 135 key entries, illustrates a similar approach to developing helpful insights.

The Dow Jones Industrial Average is the average of these thirty stocks, and is a commonly used indicator of general trends in the prices of stocks and bonds in the United States. The Dow Jones Industrial Average was first published by Wall Street Journal editor Charles Dow in 1896 with twelve stocks. The only stock of the original twelve that is still a part of the Average is General Electric.

Unlike other indexes, the stocks in the Dow are weighted according to the price of one share of each company's stock, rather than by its market capitalization (overall company value). Thus the higher the stock price, the greater weight it has in the Dow. This tends to eliminate companies maintaining high prices for their shares, such as Amazon and Google, from being considered for inclusion in the Dow. The last time the Dow changed its component stocks was in March 2015, The last time the Dow changed its component stocks was in June 2018, when it replaced General Electric with Walgreens. The prior substitution was in March 2015 by the Dow, when it replaced AT&T (T) with Apple (AAPL). Due to the erosion of manufacturing jobs in the United States resultant from harmful free trade policies, the Dow is not really "industrial" any more.

As of June 2018 here are the 30 stocks in the "Dow" several of which are retail stocks or dependent on retail sales (e.g., AXP, CSCO, HD, KO, MCD, NKE, PG, V, WBA, and WMT):

- AXP - American Express Co

- AMGN - Amgen

- AAPL - Apple Inc

- BA - Boeing Co

- CAT - Caterpillar Inc

- CSCO - Cisco Systems Inc

- CVX - Chevron Corp

- DWDP - DowDuPont Inc

- GS - Goldman Sachs Group Inc

- HD - Home Depot Inc

- HON - Honeywell

- IBM - International Business Machines Corp

- INTC - Intel Corp

- JNJ - Johnson & Johnson

- KO - Coca-Cola Co

- JPM - JPMorgan Chase & Co

- MCD - McDonald's Corp

- MMM - 3M Co

- MRK - Merck & Co Inc

- MSFT - Microsoft Corp

- NKE - Nike Inc

- PG - Procter & Gamble Co

- CRM - Salesforce.com

- TRV - Travelers Companies Inc

- UNH - UnitedHealth Group Inc

- VZ - Verizon Communications Inc

- V - Visa Inc

- WBA - Walgreens Boots Alliance

- WMT - Wal-Mart Stores Inc

- DIS - Walt Disney Co

| Year | closing price | change | % change | coeff. var volatility |

|---|---|---|---|---|

| 2007 | 13,265 | +802 | +6.4% | 3.95% |

| 2008 | 8,776 | -4,488 | -33.8% | 13.70% |

| 2009 | 10,428 | +1,652 | +18.8% | 11.30% |

| 2010 | 11,578 | +1,149 | +11.0% | 4.35% |

| 2011 | 12,218 | +640 | +5.5% | 4.15% |

| 2012 | 13,104 | +887 | +7.3% | 2.50% |

| 2013 | 16,577 | +3,473 | +26.5% | 4.80% |

| 2014 | 17,823 | +1,246 | +7.5% | 3.30% |

| 2015 | 17,425 | -398 | -2.2% | 3.15% |

| 2016 | 19,763 | +2,338 | +13.4% | |

| 2017 | 24,719 | +4,957 | +25.1% |

| Quarter | closing price | change | % change | coeff. var volatility |

|---|---|---|---|---|

| 2008 1st | 12,263 | -1,002 | -7.6% | 2.30% |

| 2nd | 11,350 | -913 | -7.3% | 3.40% |

| 3rd | 10,851 | -499 | -4.4% | 2.25% |

| 4th | 8,776 | -2,074 | -19.1% | 12.15% |

| 2009 1st | 7,609 | -1,167 | -13.3% | 8.05% |

| 2nd | 8,447 | +838 | +11.0% | 3.25% |

| 3rd | 9,712 | +1,265 | +15.0% | 5.30% |

| 4th | 10,428 | +716 | +7.4% | 2.90% |

Sources

See also

- Recent performance of individual stocks in the DJIA

- The Ins and Outs of the Dow Jones Industrial Average. The Wall Street Journal. Retrieved January 25, 2017.