Difference between revisions of "Obamanomics"

m (→Tax increases) |

(→Key Components of Obamanomics: sustainable) |

||

| Line 3: | Line 3: | ||

==Key Components of Obamanomics== | ==Key Components of Obamanomics== | ||

[[File:GDP Q2 1983.JPG|175px|right|thumb|Reaganomics produced 3%+ sustained growth immediately, and more than 22 million new jobs were created over the next 28 years.]] | [[File:GDP Q2 1983.JPG|175px|right|thumb|Reaganomics produced 3%+ sustained growth immediately, and more than 22 million new jobs were created over the next 28 years.]] | ||

| − | Obamanomics is diametrically opposed to [[Reaganomics]], embraces higher taxes, more regulation, more spending, and loose money.<ref>[http://online.wsj.com/article/SB123431484726570949.html Wall Street Journal: Reaganomics v. Obamanomics]</ref> Whereas Reaganomics jump started recovery during the 1980s, Obamanomics is expected to impede recovery. | + | Obamanomics is diametrically opposed to [[Reaganomics]], embraces higher taxes, more regulation, more spending, and loose money.<ref>[http://online.wsj.com/article/SB123431484726570949.html Wall Street Journal: Reaganomics v. Obamanomics]</ref> Whereas Reaganomics jump started sustainable recovery during the 1980s, Obamanomics is expected to impede recovery. |

By mid 2010 the [[U.S. Commerce Dept.]] reported [[Gross Domestic Product]] did not responded adequately to the [[economic stimulus]] passed in February 2009. More than 3 million jobs however were lost and more than a trillion dollars was added to the '''[[National debt]]'''. | By mid 2010 the [[U.S. Commerce Dept.]] reported [[Gross Domestic Product]] did not responded adequately to the [[economic stimulus]] passed in February 2009. More than 3 million jobs however were lost and more than a trillion dollars was added to the '''[[National debt]]'''. | ||

Revision as of 20:03, October 30, 2010

Obamanomics is a term describing the school of economic thought and policy being pushed by the Obama Administration. Its main doctrine is massive government spending (as evidenced by the American Recovery and Reinvestment Act of 2009) in excess of $1 trillion, which is funded by massive borrowing through U.S. Treasury bonds[1]. With unemployment at 10.2% as of October 2009[2] and the value of the U.S. dollar plummeting[3], it has proven to be a failed system.

Contents

Key Components of Obamanomics

Obamanomics is diametrically opposed to Reaganomics, embraces higher taxes, more regulation, more spending, and loose money.[4] Whereas Reaganomics jump started sustainable recovery during the 1980s, Obamanomics is expected to impede recovery.

By mid 2010 the U.S. Commerce Dept. reported Gross Domestic Product did not responded adequately to the economic stimulus passed in February 2009. More than 3 million jobs however were lost and more than a trillion dollars was added to the National debt.

By contrast, the 3.0%+ growth rates sustained by the Reagan era tax cuts as the United States emerged from the 1982 recession provided the necessary stimulus to maintain a growing population and declining unemployment.

Increased government spending

Loose monetary policy

Increased regulation

Tax increases

On September 12, 2008 while campaigning in Dover, New Hampshire, then candidate Obama made this solemn promise to the American people:

- I can make a firm pledge: under my plan, no family making less than $250,000 will see their taxes increase - not your income taxes, not your payroll taxes. [5][6]

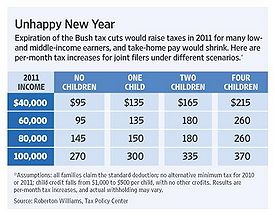

As of January 1, 2011, income taxes and payroll taxes are slated to increase on all working people in the United States, including the poor and those least able to afford it. A working family with four children, for example, will pay $215 more per month under President Obama and the Congressional Democrats economic program.

Capital gains tax

Dividends tax

Income tax

Obamaonomics proposes raising income taxes on all working Americans effective January 1, 2010. The rate of increase on the poorest workers, those least able to afford it, is 50%, from a progressive tax rate of 10% to a rate of 15%. By contrast the upper 2%, those with taxable income of $250,000, will only experience a 10% increase, from 36% to 39.6%.

Payroll tax

Cap and trade energy tax

- Main article: Cap and Trade