Difference between revisions of "Recession of 2008"

m (Obama flunking) |

m (→Obama flunking, say economists) |

||

| Line 50: | Line 50: | ||

The Obama Administration is basing its domestic policies on the assumption of a rapid economic recovery, that will generate the tax revenue needed to fund permanent new spending program in areas such as health care and greening the economy. It assumes that the rich will recover enough of their investments to pay new taxes--right now tax collections are falling sharply as investments turn sour. Administration forecasts are more optimistic than private sector forecasts, which see a 25% chance of a '''Second Great Depression'''. Congress is unlikely to approve very heavy new spending programs unless the economy improves, since a large number of conservative Democrats have been recently elected who may vote with Republicans to keep down spending and deficits.<ref> Peter S. Goodman, "Sharper Downturn Clouds Obama Spending Plans," [http://www.nytimes.com/2009/02/28/business/economy/28recession.html?_r=1&th&emc=th ''Washington Post'' Feb. 27, 2009]</ref> | The Obama Administration is basing its domestic policies on the assumption of a rapid economic recovery, that will generate the tax revenue needed to fund permanent new spending program in areas such as health care and greening the economy. It assumes that the rich will recover enough of their investments to pay new taxes--right now tax collections are falling sharply as investments turn sour. Administration forecasts are more optimistic than private sector forecasts, which see a 25% chance of a '''Second Great Depression'''. Congress is unlikely to approve very heavy new spending programs unless the economy improves, since a large number of conservative Democrats have been recently elected who may vote with Republicans to keep down spending and deficits.<ref> Peter S. Goodman, "Sharper Downturn Clouds Obama Spending Plans," [http://www.nytimes.com/2009/02/28/business/economy/28recession.html?_r=1&th&emc=th ''Washington Post'' Feb. 27, 2009]</ref> | ||

===Obama flunking, say economists=== | ===Obama flunking, say economists=== | ||

| − | Although public opinion of Obama personally remains positive, experts have turned from positive expectations in December 2008 to a negative assessment in March 2009. The ''Wall Street Journal'' survey of 49 professional economists gives poor grades to Obama and his key people. On a scale of 100 = best, Obama was scored | + | Although public opinion of Obama personally remains positive, experts have turned from positive expectations in December 2008 to a negative assessment in March 2009. The ''Wall Street Journal'' survey of 49 professional economists gives poor grades to Obama and his key people. On a scale of 100 = best, Obama was scored 59 in March 2009, Treasury Secretary Geithner 51, and Fed Chairman Bernanke 71.<ref>See Phil Izzo, "Obama, Geithner Get Low Grades From Economists," [http://online.wsj.com/article/SB123671107124286261.html ''Wall Street Journal'' Mar. 11, 2009]</ref> |

The main criticism of the Obama team was the delay in rescuing banks. "They overpromised and underdelivered," said Stephen Stanley of RBS Greenwich Capital. "Secretary Geithner scheduled a big speech and came out with just a vague blueprint. The uncertainty is hanging over everyone's head." Geithner unveiled the Obama plan Feb. 10, but he offered few details, and the Dow Jones Industrial Average is down almost 20% since the announcement, as multiple issues have troubled investors' confidence. A second criticism was that the stimulus package was not big enough, although some argued it was unnecessary. | The main criticism of the Obama team was the delay in rescuing banks. "They overpromised and underdelivered," said Stephen Stanley of RBS Greenwich Capital. "Secretary Geithner scheduled a big speech and came out with just a vague blueprint. The uncertainty is hanging over everyone's head." Geithner unveiled the Obama plan Feb. 10, but he offered few details, and the Dow Jones Industrial Average is down almost 20% since the announcement, as multiple issues have troubled investors' confidence. A second criticism was that the stimulus package was not big enough, although some argued it was unnecessary. | ||

Revision as of 08:54, March 15, 2009

The Recession of 2008 is a major worldwide economic downturn that was caused by the Financial Crisis of 2008. It continues to deepen in February 2009 and is the worst since the Great Depression of the 1930s, and is on the verge of becoming The Second Great Depression. It began in January 2008 as in financial sector as major banks in the U.S. and Europe got into serious trouble by investing in bad mortgages. Trouble spread to the automobile industry, where General Motors and Chrysler verged on bankruptcy in December, 2008, because people were not buying any new cars. They were rescued by an emergency bailout ordered by President George W. Bush over the objections of Congressional Republicans. In the U.S. GDP fell in the fourth quarter of 2008 (October-November-December), by 6.2% annual rate, with declines heaviest in business investment, exports, finance, autos, housing, construction, and retail sales.[1] The stock market fell by 50% in 2008, wiping out trillions of dollars in assets. More trillions were lost as housing prices fell by 20%. Adding together the declines in housing and the stock market, the net worth of American households declined from $63.7 trillion in January 2008 to $51.5 trillion in January 2009, a decline of $11.2 trillion or 18%. That is, Americans owned $11 trillion less wealth, and adjusted by buying less and investing less. Meanwhile mortgages and credit-card debt together reached $13 trillion, or 123% of after-tax income, a huge jump since 1995, when it was 83% of income.[2]

Wealth levels plunged worldwide. Stock markets in other major countries fell even faster than the U.S. Most companies worldwide reported reduced sales and sharply reduced profits, as banks refused to lend and consumers refused to spend, fearing the worst.

A series of emergency measures enacted by the Federal Reserve (on its own authority) and Congress after heavy prodding by presidents Bush and Obama resulted in trillions of dollars in loans, banking bailouts and guarantees, a half-trillion new stimulus spending and a third of a trillion in tax cuts, but by mid-March 2009 the outlook remained bleak as the economy coontinued downward.

The crisis is worldwide, with major impact in Britain, Europe (the EU), Russia, Japan, the oil countries of the Middle East, and the Third World. China continues to grow but at a sharply reduced rate. Major countries are experimenting with Keynesian stimulus poackages, including the US ($787 billion), Europe (EU, $634 billion), China ($586 billion), and Japan ($486 billion), but so far no positive results have been reported. Central banks (such as the Federal Reserve in the U.S.) have cut interest rates to nearly zero, but few are borrowing money.

Contents

Indicators down

Oil, metal and grain (rice, wheat, corn) prices, after hitting record levels in the summer of 2008, have plunged. Oil went from $145 a barrel to $42.

Retail sales in the U.S. and worldwide are in a major slump, with the slowest Christmas shopping season in decades. American manufacturing contracted in November 2008 at the steepest rate in 26 years. The U.S. lost some 2.6 million jobs in 2008, the worst record since the end of World War II, Factory indexes in China, Britain, Europe, and Russia all fell to record lows.

In January 2009 the downturn worsened, as major companies and small firms announced round after round of layoffs and postponement of expansion plans. The financial sector worsened sharply in January, indicating the the huge financial bailouts of 2008 were not enough. The steep slide continued as unsold goods piled up. The GDP (gross domestic product) shrank at a -6.2% annual rate in the fourth quarter (last three months) of 2008, the sharpest contraction in 26 years.[3]

Meanwhile, at the urging of the Obama Administration, Congress passed a $789 billion stimulus package, combining new spending and tax cuts, in the hopes of turning the economy around by mid-2009. Republicans were nearly unanimous against the proposal, as their smaller package was voted down. Canada, although not as hard hit as the U.S., is preparing its own stimulus package.

- see also Economic stimulus package

Economists from all political viewpoints predict the slide in GDP is likely to continue at an alarming pace well into summer 2009 as consumers continue to curtail spending and businesses reduce their capital investments and cut their payrolls.

US

The longest economic slumps since 1945 were the 16-month downturns that ended in March 1975 and November 1982. The Great Depression lasted 43 months, from August 1929 to March 1933.

"This may be referred to as the Great Recession," because of its length, said Norbert Ore, chairman of the Institute for Supply Management’s factory survey. "It looked like we were headed for a shallow recession earlier in the year because of higher energy prices. With the meltdown in the financial sector, it has become something more serious."[4]

Auto crisis

The automobile industry is in desperate crisis, with General Motors and Chrysler, and numerous parts suppliers, on the verge of bankruptcy. Ford is in better shape as are the "transplants" like Toyota and Honda that have factories in the U.S. If GM shuts down, however, many parts suppliers will also shut, forcing the end of most US auto production. Autos will still be imported, though at much higher prices. GM and Chrysler were given $17 billion TARP funds in December on condition they present a turnaround plan by Feb. 17, 2009. In its plan GM will ask for access to an additional $16.6 billion in federal aid; otherwise will run out of money by March 2009. GM also said it would close 14 U.S. plants, and cut 47,000 global hourly, salaried jobs. Bankruptcy, GM said, would cost the federal government $100 billion in losses, as well as the loss of 1.3 million jobs across the US, as plants and dealers close down operation.[5]

In March 2009 GM reported that its auditors have raised substantial doubts about its ability to continue as a going concern, citing recurring losses from operations, stockholders' deficit and an inability to generate enough cash to meet its obligations. GM has received $13.4 billion in federal loans, and the company is seeking a total of $30 billion from the government. During the past three years it has run up $82 billion in losses, including $30.9 billion in 2008. Bankruptcy appears very likely.

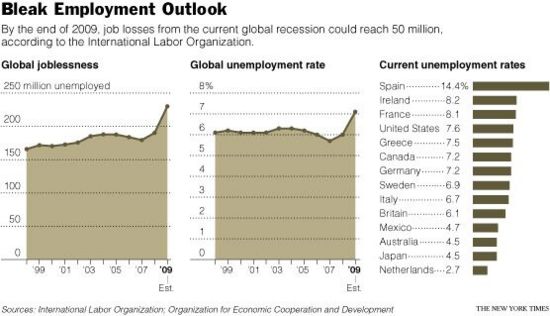

Unemployment

After reaching a low of 4.1% in October, 2006, the U.S. unemployment rate has been trending upward, reaching 8.1% in February 2009. Analysts from the National Bureau of Economic research say that the current nation-wide recession began a full year ago; the economy peaked in December, 2007. This recession is expected to continue into 2010. Unemployment reached 6.5% in November 2008. Unemployment has already reached 10% and higher in some industrial areas of the U.S. and the West Coast.

The unemployment rate nationally in November 2008 was 6.5%, shown in chart below in dark blue. Michigan had the highest unemployment at over 9%. In the West, California, Oregon, and Nevada all had relatively high unemployment levels, all around 8%.

Worldwide crisis

The crisis is worse in many other countries, which means they are dragging down the US economy and cannot be expected to be the engine to restore prosperity. Japan’s economy, the world’s second largest after the U.S., is deteriorating rapidly because of shrinking exports and weak domestic spending. Japan's GDP shrank at an annual rate of 12.7% in the fourth quarter of 2008, and the downward plunge shows no sign of reversal.

Japan's exports to the U.S. and other areas are down sharply, causing massive layoffs at companies like Nissan, Toyota, Panasonic and Sony. Capital spending on tools and factories has fallen as companies halted production lines and cut investment. Consumer spending has stalled as Japanese households reduced spending amid the large-scale layoffs. The government has promised a huge bailout package on the order of 50 trillion yen ($545 billion), but has been unable to get it passed in parliament.[6]

Japan's exports to the U.S. and other areas are down sharply, causing massive layoffs at companies like Nissan, Toyota, Panasonic and Sony. Capital spending on tools and factories has fallen as companies halted production lines and cut investment. Consumer spending has stalled as Japanese households reduced spending amid the large-scale layoffs. The government has promised a huge bailout package on the order of 50 trillion yen ($545 billion), but has been unable to get it passed in parliament.[6]

The economies in Europe and Russia are headed down, as are most third world countries. Eastern Europe is very hard hit, as is Ireland and Iceland. Economic growth in China continues at a much lower pace than usual, throwing tens of millions out of work there. The oil producing nations have seen their revenues plunge with the decline of oil prices.

U.S. Politics

The Obama Administration is basing its domestic policies on the assumption of a rapid economic recovery, that will generate the tax revenue needed to fund permanent new spending program in areas such as health care and greening the economy. It assumes that the rich will recover enough of their investments to pay new taxes--right now tax collections are falling sharply as investments turn sour. Administration forecasts are more optimistic than private sector forecasts, which see a 25% chance of a Second Great Depression. Congress is unlikely to approve very heavy new spending programs unless the economy improves, since a large number of conservative Democrats have been recently elected who may vote with Republicans to keep down spending and deficits.[7]

Optimism or pessimism?

The Obama Administration is basing its domestic policies on the assumption of a rapid economic recovery, that will generate the tax revenue needed to fund permanent new spending program in areas such as health care and greening the economy. It assumes that the rich will recover enough of their investments to pay new taxes--right now tax collections are falling sharply as investments turn sour. Administration forecasts are more optimistic than private sector forecasts, which see a 25% chance of a Second Great Depression. Congress is unlikely to approve very heavy new spending programs unless the economy improves, since a large number of conservative Democrats have been recently elected who may vote with Republicans to keep down spending and deficits.[8]

Obama flunking, say economists

Although public opinion of Obama personally remains positive, experts have turned from positive expectations in December 2008 to a negative assessment in March 2009. The Wall Street Journal survey of 49 professional economists gives poor grades to Obama and his key people. On a scale of 100 = best, Obama was scored 59 in March 2009, Treasury Secretary Geithner 51, and Fed Chairman Bernanke 71.[9]

The main criticism of the Obama team was the delay in rescuing banks. "They overpromised and underdelivered," said Stephen Stanley of RBS Greenwich Capital. "Secretary Geithner scheduled a big speech and came out with just a vague blueprint. The uncertainty is hanging over everyone's head." Geithner unveiled the Obama plan Feb. 10, but he offered few details, and the Dow Jones Industrial Average is down almost 20% since the announcement, as multiple issues have troubled investors' confidence. A second criticism was that the stimulus package was not big enough, although some argued it was unnecessary.

The economists are increasingly pessimistic about the economy, predicting it will shed another 2.8 million jobs over the next 12 months as the unemployment rate climbs to 9.3% by December, up from the 8.1% rate recorded in February. Economists see a one-in-six chance that the U.S. will fall into a depression, defined as a decline in per-person GDP or consumption by 10% or more. 70% of the economists give equally poor marks to the efforts of other countries to end the recession. "The Europeans or Japanese don't seem to be doing near enough to kickstart their economies," said Nariman Behravesh of IHS Global Insight. "It could be we've done all the right things, but the rest of the world goes down the tubes."

The economists, however, were broadly supportive of the Federal reserve. Over 85% agreed that its proliferating lending programs are well-designed, well-executed and helping the economy.

Notes

- ↑ Three of the four engines of economic growth -- consumer spending, business investment and exports -- declined sharply. Consumer spending fell at an annualized rate of 4.3%; bsiness investment in equipment and software sank at an astonishing annual rate of 29%; exports of goods and services plunged 24%. Washington Post Feb. 28, 2009

- ↑ see S. Mitra Kalita, "Americans See 18% of Wealth Vanish," Wall Street Journal Mar. 13, 2009

- ↑ Jack Healy And Louis Uchitelle, "Steep Slide in U.S. Economy as Unsold Goods Pile Up," New York Times Jan. 30, 2009

- ↑ see Steve Matthews and Timothy R. Homan, "U.S. May Be in for ‘Great Recession,’" Bloomberg News Dec 2, 2008

- ↑ . For the GM plan see GM Plan of Feb 17, 2009

- ↑ Hiroku Tabuschi, "Japan’s Economy Plunges at Fastest Pace Since ’74," New York Times Feb. 15, 2009

- ↑ Peter S. Goodman, "Sharper Downturn Clouds Obama Spending Plans," Washington Post Feb. 27, 2009

- ↑ Peter S. Goodman, "Sharper Downturn Clouds Obama Spending Plans," Washington Post Feb. 27, 2009

- ↑ See Phil Izzo, "Obama, Geithner Get Low Grades From Economists," Wall Street Journal Mar. 11, 2009