Difference between revisions of "Timothy Geithner"

(Who was gushing over Tim Geithner? Who would?) |

|||

| Line 43: | Line 43: | ||

[[Image:Toxic-2-assets.jpg|thumb|290px|left]] | [[Image:Toxic-2-assets.jpg|thumb|290px|left]] | ||

With Geithner losing more of his credibility as a problem solver, he came back with a plan on March 23 that will not need additional funding or approval by Congress. The Treasury will use $100 billion from the Troubled Asset Relief Program (TARP), as well as new capital from private investors, in order to generate $500 billion in purchasing power to buy toxic loans and assets. The program could potentially expand to $1 trillion over time, and initial responses by Wall Street have been favorable. | With Geithner losing more of his credibility as a problem solver, he came back with a plan on March 23 that will not need additional funding or approval by Congress. The Treasury will use $100 billion from the Troubled Asset Relief Program (TARP), as well as new capital from private investors, in order to generate $500 billion in purchasing power to buy toxic loans and assets. The program could potentially expand to $1 trillion over time, and initial responses by Wall Street have been favorable. | ||

| + | |||

| + | ==See Also== | ||

| + | * [[American economic history]] | ||

| + | * [[Essay:Invest in tangibles]] - [[:Category:Survivalism|Economic preparedness]] | ||

| + | * [[Inflation]] versus [[Interest rate]]s / [[Rate of return]]-[[Expected return]] | ||

| + | * [[Self-directed IRA]] and [[IRA]], [[401(k)]], Roth IRA, [[403(b)]], [[Retirement]], [[Social security]] | ||

| + | |||

| + | ---- | ||

| + | |||

| + | * [[:Category:Banksters|Banksters]]: [[MF Global]], [[Goldman Sachs]] | ||

| + | |||

| + | * [[National debt]]: [[Debt Ceiling]]-[[Deficit spending]] and the [[Federal Reserve System]]'s [[Ponzi scheme]] of [[Quantitative easing]]-[[Debt monetization]] [[devaluation]] of [[Fiat currency]] through [[Money supply]]-[[Treasury bill]]s bought mostly by [[China]] and [[Japan]] | ||

| + | [[File:Shovelready.jpg|right|250px]] | ||

| + | |||

| + | * [[Globalization]], [[Globalism]], [[International Monetary Fund]], [[World Bank]] | ||

| + | |||

| + | * [[John Maynard Keynes]] [[liberal]] [[Keynesian economics]] and [[Fabian Socialism|Fabian Socialist]] influence on [[Barack Obama]] | ||

| + | |||

| + | * '''[[Big government | Big Government]]''': [[Liberal values|Liberal]] [[ObamaCare]]-[[Common Core]]-[[Social Security]] [[Welfare state]] leads to [[Nanny state]], leads to [[Gun control]], [[Militarization of police]], [[Asset forfeiture]] and Domestic [[mass surveillance]] of law-abiding [[citizen]]s via the '''[[Police state]]''': [[Globalist]]-[[United Nations]]-[[Statist]]-[[Socialist]]-[[National Socialist]]-[[Communist]] | ||

| + | |||

| + | |||

| + | '''Contrast with:''' | ||

| + | |||

| + | * [[Ludwig von Mises]]' [[conservative]] [[libertarian]] [[Austrian economics]] and [[Fiscal conservatism]] -[[Capitalist]] [[Conservative economic policies]] of [[Ron Paul]] | ||

| + | |||

| + | * [[Gold standard]] and [[precious metal]]s | ||

| + | |||

| + | * [[Essay:Invest in tangibles|Invest in tangibles]] for [[:Category:Survivalism|Economic preparedness]] | ||

| + | |||

| + | * '''[[Limited government]]''' implies: [[Conservative values]]/[[Traditional values]] - [[Modern conservatism]] - [[Preparedness | Modern preparedness]] are the original [[American]] [[Patriot]] [[Founding Fathers]]' values | ||

| + | |||

| + | * [[Modern preparedness]]: "[[if times get tough, or even if then don't]]", [[Debt is financial cancer]], [[Tax is theft]], [[Renewable energy]], [[Financial security]], [[You are in control of your life]] | ||

| + | |||

| + | ** [[Invest in tangibles]] - [[Rural]] [[farm]] [[land]], [[Tools]], [[Food storage]], [[Precious Metals]], [[Ammunition | Copper-jacketed lead]] and [[Firearms]] | ||

| + | |||

| + | ** [[Agriculture]]-[[Permaculture]]: [[Growing your own food]], [[Food and water storage]] | ||

| + | |||

| + | |||

| + | ==References== | ||

| + | {{reflist|2}} | ||

| + | |||

==External links== | ==External links== | ||

*[http://www.ustreas.gov/ Department of Treasury] | *[http://www.ustreas.gov/ Department of Treasury] | ||

| − | |||

| − | |||

[[Category:Finance]] | [[Category:Finance]] | ||

| Line 57: | Line 96: | ||

{{DEFAULTSORT:Geithner, Timothy}} | {{DEFAULTSORT:Geithner, Timothy}} | ||

| + | |||

| + | |||

| + | [[Category:Banksters]] | ||

| + | [[Category:Economics]] | ||

Revision as of 06:54, December 10, 2014

| Timothy Geithner | |||

|---|---|---|---|

| |||

| 75th United States Secretary of the Treasury From: January 26, 2009-February 28, 2013 | |||

| President | Barack Hussein Obama | ||

| Predecessor | Henry Paulson | ||

| Successor | Jack Lew | ||

| Information | |||

| Party | Democrat | ||

| Spouse(s) | Carole M. Sonnenfeld | ||

Contents

Career

Educated at Dartmouth and Johns Hopkins, he spent many years abroad. Previously he was president of the powerful Federal Reserve Bank of New York. Geithner started as a Republican and changed his voter registration — to Independent — only in the late 1990s, when he became under secretary for international affairs in the Clinton administration.

President of New York Federal Reserve Bank

In 2008 he was deeply involved in the complex moves by the Federal Reserve and the Treasury to bailout banks in the Financial Crisis of 2008. That included $700 billion in money sought by president George W. Bush and passed by bipartisan majorities in Congress in October, 2008, and trillions in loan guarantees made by the Federal Reserve on its own authority. Geithner now is the person most responsible for bringing recovery to the economy.

Geithner was appointed to the Treasury largely on the basis of his work at the New York Fed. His most important action there was design the bailout of giant insurance firm AIG, with 80% government ownership of AIG. It received $170 billion from the government. AIG scandalized the nation in March 2009 by giving out $165 million in bonuses to the very people who caused it to lose over $60 billion after the government took it over.

Treasury Secretary

In the confirmation hearings in January 2009 he was publicly humiliated by the Senate (controlled by Democrats) when it seemed he deliberately evaded over $40,000 of federal taxes. He paid the taxes and penalties and was confirmed, with most Republicans opposed. Geithner and the Obama Administration moved moved to handle the crisis on two fronts. Working with Democrats in Congress (and three moderate Republican Senators), they passed the an economic stimulus bill, the "American Recovery and Reinvestment Act of 2009", with $500 billion of new spending and nearly $300 billion in new tax cuts. The stimulus will begin operations in mid-February, 2009, and supporters hoped it would slow the nosediving economy. Conservative critics feared it would be ineffective in the short run and add to the national debt and tax burdens in the long run.

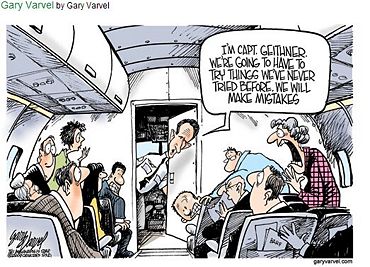

Calls For Resignation

Republican Representative Kevin Brady of Texas told Geithner he has ‘Lost All Confidence’, thats how both liberals Democrats and conservative Republicans now view Geithner's position. Democrat Representative Peter DeFazio of Oregon told MSNBC that Geithner needed to go. Representative Michael Burgess of Texas, also expressed dissatisfaction with Geithner, [1]

| “ | I don’t think you should be fired,” Burgess told him. “I thought you should have never been hired. | ” |

Bailout plans

With banks on the verge of failure, Geithner unveiled yet another massive bailout program in mid-February. Trillions would be spent to move toxic assets out of the banks, but the unanimous reaction was negative and Geithner hung on to his job, but had to come up with a better plan. Geithner has the authority to decide what to do with the second tranche of $350 billion from the $700 billion banking bailout bill passed by Congress in October 2008.

With Geithner losing more of his credibility as a problem solver, he came back with a plan on March 23 that will not need additional funding or approval by Congress. The Treasury will use $100 billion from the Troubled Asset Relief Program (TARP), as well as new capital from private investors, in order to generate $500 billion in purchasing power to buy toxic loans and assets. The program could potentially expand to $1 trillion over time, and initial responses by Wall Street have been favorable.

See Also

- American economic history

- Essay:Invest in tangibles - Economic preparedness

- Inflation versus Interest rates / Rate of return-Expected return

- Self-directed IRA and IRA, 401(k), Roth IRA, 403(b), Retirement, Social security

- National debt: Debt Ceiling-Deficit spending and the Federal Reserve System's Ponzi scheme of Quantitative easing-Debt monetization devaluation of Fiat currency through Money supply-Treasury bills bought mostly by China and Japan

- John Maynard Keynes liberal Keynesian economics and Fabian Socialist influence on Barack Obama

- Big Government: Liberal ObamaCare-Common Core-Social Security Welfare state leads to Nanny state, leads to Gun control, Militarization of police, Asset forfeiture and Domestic mass surveillance of law-abiding citizens via the Police state: Globalist-United Nations-Statist-Socialist-National Socialist-Communist

Contrast with:

- Ludwig von Mises' conservative libertarian Austrian economics and Fiscal conservatism -Capitalist Conservative economic policies of Ron Paul

- Limited government implies: Conservative values/Traditional values - Modern conservatism - Modern preparedness are the original American Patriot Founding Fathers' values

- Modern preparedness: "if times get tough, or even if then don't", Debt is financial cancer, Tax is theft, Renewable energy, Financial security, You are in control of your life

References