Difference between revisions of "Dow Jones Industrial Average"

(chart) |

(add Nike as a stock which is dependent on retail) |

||

| (21 intermediate revisions by 7 users not shown) | |||

| Line 1: | Line 1: | ||

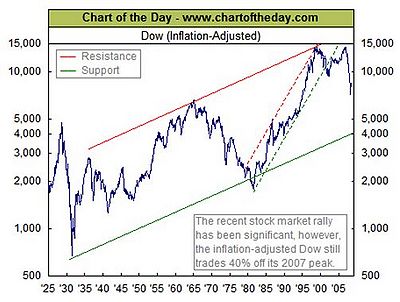

| − | The '''Dow Jones Industrial Average''', commonly known as the '''Dow Jones''', is a [[stock]] price index based on | + | The '''Dow Jones Industrial Average''', commonly known as the '''[[Dow Jones]]''' or simply the '''Dow''', is a [[stock]] price index based on thirty prominent [[stocks]] on the [[New York Stock Exchange]]. [[File:Dow1925-2009.jpg|400px|thumb|Dow Jones index since 1925, in constant 2009 dollars]] The DJIA can be traded under the stock symbol DIA. The other two major indexes are the "S&P500" (which can be traded under the symbol "SPY") and "NASDAQ" (the trading symbol "QQQ" somewhat tracks that index). |

| + | The Dow Jones Industrial Average is the average of these thirty stocks, and is a commonly used indicator of general trends in the prices of [[stock]]s and [[bond]]s in the [[United States]]. The Dow Jones Industrial Average was first published by ''[[Wall Street Journal]]'' editor Charles Dow in 1896 with twelve stocks. The only stock of the original twelve that is still a part of the Average is [[General Electric]]. | ||

| − | + | Unlike other indexes, the stocks in the Dow are weighted according to the price of one share of each company's stock, rather than by its market capitalization (overall company value). Thus the higher the stock price, the greater weight it has in the Dow. This tends to eliminate companies maintaining high prices for their shares, such as Amazon and Google, from being considered for inclusion in the Dow. The last time the Dow changed its component stocks was in March 2015, The last time the Dow changed its component stocks was in March 2015, when it replaced AT&T (T) with Apple (AAPL). Due to the erosion of manufacturing jobs in the [[United States]] resultant from harmful [[free trade]] policies, the Dow is not really "industrial" any more. | |

| + | |||

| + | As of June 2017 here are the 30 stocks in the "Dow" several of which are retail stocks or dependent on retail sales (e.g., AXP, CSCO, HD, KO, MCD, NKE, PG, V, and WMT): | ||

| + | |||

| + | *AXP - American Express Co | ||

| + | *AAPL - Apple Inc | ||

| + | *BA - Boeing Co | ||

| + | *CAT - Caterpillar Inc | ||

| + | *CSCO - Cisco Systems Inc | ||

| + | *CVX - Chevron Corp | ||

| + | *DD - E I du Pont de Nemours and Co | ||

| + | *XOM - Exxon Mobil Corp | ||

| + | *GE - General Electric Co | ||

| + | *GS - Goldman Sachs Group Inc | ||

| + | *HD - Home Depot Inc | ||

| + | *IBM - International Business Machines Corp | ||

| + | *INTC - Intel Corp | ||

| + | *JNJ - Johnson & Johnson | ||

| + | *KO - Coca-Cola Co | ||

| + | *JPM - JPMorgan Chase & Co | ||

| + | *MCD - McDonald's Corp | ||

| + | *MMM - 3M Co | ||

| + | *MRK - Merck & Co Inc | ||

| + | *MSFT - Microsoft Corp | ||

| + | *NKE - Nike Inc | ||

| + | *PFE - Pfizer Inc | ||

| + | *PG - Procter & Gamble Co | ||

| + | *TRV - Travelers Companies Inc | ||

| + | *UNH - UnitedHealth Group Inc | ||

| + | *UTX - United Technologies Corp | ||

| + | *VZ - Verizon Communications Inc | ||

| + | *V - Visa Inc | ||

| + | *WMT - Wal-Mart Stores Inc | ||

| + | *DIS - Walt Disney Co | ||

| + | |||

| + | {| class="wikitable" style="font-size:98%; margin:left;" | ||

| + | |+ | ||

| + | |+ | ||

| + | !Year | ||

| + | !closing price | ||

| + | !change | ||

| + | !% change | ||

| + | !coeff. var<br>volatility | ||

| + | |- | ||

| + | !2007 | ||

| + | |align="right"|13,265 | ||

| + | |align="right"|+802 | ||

| + | |align="right"|+6.4% | ||

| + | |align="right"|3.95% | ||

| + | |- | ||

| + | !2008 | ||

| + | |align="right"|8,776 | ||

| + | |align="right"|-4,488 | ||

| + | |align="right"|-33.8% | ||

| + | |align="right"|13.70% | ||

| + | |- | ||

| + | !2009 | ||

| + | |align="right"|10,428 | ||

| + | |align="right"|+1,652 | ||

| + | |align="right"|+18.8% | ||

| + | |align="right"|11.30% | ||

| + | |- | ||

| + | !2010 | ||

| + | |align="right"|11,578 | ||

| + | |align="right"|+1,149 | ||

| + | |align="right"|+11.0% | ||

| + | |align="right"|4.35% | ||

| + | |- | ||

| + | !2011 | ||

| + | |align="right"|12,218 | ||

| + | |align="right"|+640 | ||

| + | |align="right"|+5.5% | ||

| + | |align="right"|4.15% | ||

| + | |- | ||

| + | !2012 | ||

| + | |align="right"|13,104 | ||

| + | |align="right"|+887 | ||

| + | |align="right"|+7.3% | ||

| + | |align="right"|2.50% | ||

| + | |- | ||

| + | !2013 | ||

| + | |align="right"|16,577 | ||

| + | |align="right"|+3,473 | ||

| + | |align="right"|+26.5% | ||

| + | |align="right"|4.80% | ||

| + | |- | ||

| + | !2014 | ||

| + | |align="right"|17,823 | ||

| + | |align="right"|+1,246 | ||

| + | |align="right"|+7.5% | ||

| + | |align="right"|3.30% | ||

| + | |- | ||

| + | !2015 | ||

| + | |align="right"|17,425 | ||

| + | |align="right"|-398 | ||

| + | |align="right"|-2.2% | ||

| + | |align="right"|3.15% | ||

| + | |- | ||

| + | |} | ||

| + | |||

| + | |||

| + | {| class="wikitable" style="font-size:98%; margin:left;" | ||

| + | |+ | ||

| + | |+2008-2009 by quarter | ||

| + | !Quarter | ||

| + | !closing price | ||

| + | !change | ||

| + | !% change | ||

| + | !coeff. var<br>volatility | ||

| + | |- | ||

| + | |align="right"|2008 1st | ||

| + | |align="right"|12,263 | ||

| + | |align="right"|-1,002 | ||

| + | |align="right"|-7.6% | ||

| + | |align="right"|2.30% | ||

| + | |- | ||

| + | |align="right"|2nd | ||

| + | |align="right"|11,350 | ||

| + | |align="right"|-913 | ||

| + | |align="right"|-7.3% | ||

| + | |align="right"|3.40% | ||

| + | |- | ||

| + | |align="right"|3rd | ||

| + | |align="right"|10,851 | ||

| + | |align="right"|-499 | ||

| + | |align="right"|-4.4% | ||

| + | |align="right"|2.25% | ||

| + | |- | ||

| + | |align="right"|4th | ||

| + | |align="right"|8,776 | ||

| + | |align="right"|-2,074 | ||

| + | |align="right"|-19.1% | ||

| + | |align="right"|12.15% | ||

| + | |- | ||

| + | |align="right"|2009 1st | ||

| + | |align="right"|7,609 | ||

| + | |align="right"|-1,167 | ||

| + | |align="right"|-13.3% | ||

| + | |align="right"|8.05% | ||

| + | |- | ||

| + | |align="right"|2nd | ||

| + | |align="right"|8,447 | ||

| + | |align="right"|+838 | ||

| + | |align="right"|+11.0% | ||

| + | |align="right"|3.25% | ||

| + | |- | ||

| + | |align="right"|3rd | ||

| + | |align="right"|9,712 | ||

| + | |align="right"|+1,265 | ||

| + | |align="right"|+15.0% | ||

| + | |align="right"|5.30% | ||

| + | |- | ||

| + | |align="right"|4th | ||

| + | |align="right"|10,428 | ||

| + | |align="right"|+716 | ||

| + | |align="right"|+7.4% | ||

| + | |align="right"|2.90% | ||

| + | |- | ||

| + | |} | ||

==Sources== | ==Sources== | ||

| − | http://usinfo.state.gov/products/pubs/oecon/chap12.htm | + | * http://usinfo.state.gov/products/pubs/oecon/chap12.htm |

| + | |||

| + | ==See also== | ||

| + | *[http://money.cnn.com/data/markets/dow/ Recent performance of individual stocks in the DJIA] | ||

| + | *[http://www.wsj.com/graphics/djia-components-history/ The Ins and Outs of the Dow Jones Industrial Average]. ''The Wall Street Journal''. Retrieved January 25, 2017. | ||

| − | [[Category:Stock | + | [[Category:Stock Market]] |

Revision as of 02:46, June 7, 2017

The Dow Jones Industrial Average, commonly known as the Dow Jones or simply the Dow, is a stock price index based on thirty prominent stocks on the New York Stock Exchange. The DJIA can be traded under the stock symbol DIA. The other two major indexes are the "S&P500" (which can be traded under the symbol "SPY") and "NASDAQ" (the trading symbol "QQQ" somewhat tracks that index).The Dow Jones Industrial Average is the average of these thirty stocks, and is a commonly used indicator of general trends in the prices of stocks and bonds in the United States. The Dow Jones Industrial Average was first published by Wall Street Journal editor Charles Dow in 1896 with twelve stocks. The only stock of the original twelve that is still a part of the Average is General Electric.

Unlike other indexes, the stocks in the Dow are weighted according to the price of one share of each company's stock, rather than by its market capitalization (overall company value). Thus the higher the stock price, the greater weight it has in the Dow. This tends to eliminate companies maintaining high prices for their shares, such as Amazon and Google, from being considered for inclusion in the Dow. The last time the Dow changed its component stocks was in March 2015, The last time the Dow changed its component stocks was in March 2015, when it replaced AT&T (T) with Apple (AAPL). Due to the erosion of manufacturing jobs in the United States resultant from harmful free trade policies, the Dow is not really "industrial" any more.

As of June 2017 here are the 30 stocks in the "Dow" several of which are retail stocks or dependent on retail sales (e.g., AXP, CSCO, HD, KO, MCD, NKE, PG, V, and WMT):

- AXP - American Express Co

- AAPL - Apple Inc

- BA - Boeing Co

- CAT - Caterpillar Inc

- CSCO - Cisco Systems Inc

- CVX - Chevron Corp

- DD - E I du Pont de Nemours and Co

- XOM - Exxon Mobil Corp

- GE - General Electric Co

- GS - Goldman Sachs Group Inc

- HD - Home Depot Inc

- IBM - International Business Machines Corp

- INTC - Intel Corp

- JNJ - Johnson & Johnson

- KO - Coca-Cola Co

- JPM - JPMorgan Chase & Co

- MCD - McDonald's Corp

- MMM - 3M Co

- MRK - Merck & Co Inc

- MSFT - Microsoft Corp

- NKE - Nike Inc

- PFE - Pfizer Inc

- PG - Procter & Gamble Co

- TRV - Travelers Companies Inc

- UNH - UnitedHealth Group Inc

- UTX - United Technologies Corp

- VZ - Verizon Communications Inc

- V - Visa Inc

- WMT - Wal-Mart Stores Inc

- DIS - Walt Disney Co

| Year | closing price | change | % change | coeff. var volatility |

|---|---|---|---|---|

| 2007 | 13,265 | +802 | +6.4% | 3.95% |

| 2008 | 8,776 | -4,488 | -33.8% | 13.70% |

| 2009 | 10,428 | +1,652 | +18.8% | 11.30% |

| 2010 | 11,578 | +1,149 | +11.0% | 4.35% |

| 2011 | 12,218 | +640 | +5.5% | 4.15% |

| 2012 | 13,104 | +887 | +7.3% | 2.50% |

| 2013 | 16,577 | +3,473 | +26.5% | 4.80% |

| 2014 | 17,823 | +1,246 | +7.5% | 3.30% |

| 2015 | 17,425 | -398 | -2.2% | 3.15% |

| Quarter | closing price | change | % change | coeff. var volatility |

|---|---|---|---|---|

| 2008 1st | 12,263 | -1,002 | -7.6% | 2.30% |

| 2nd | 11,350 | -913 | -7.3% | 3.40% |

| 3rd | 10,851 | -499 | -4.4% | 2.25% |

| 4th | 8,776 | -2,074 | -19.1% | 12.15% |

| 2009 1st | 7,609 | -1,167 | -13.3% | 8.05% |

| 2nd | 8,447 | +838 | +11.0% | 3.25% |

| 3rd | 9,712 | +1,265 | +15.0% | 5.30% |

| 4th | 10,428 | +716 | +7.4% | 2.90% |

Sources

See also

- Recent performance of individual stocks in the DJIA

- The Ins and Outs of the Dow Jones Industrial Average. The Wall Street Journal. Retrieved January 25, 2017.