Federal Debt Limit

The Federal Debt Limit, commonly known as the debt ceiling, is the overall limit on federal government borrowing, as authorized by Congress. It is similar to an individual's credit card limit. As of early July 2025, the U.S. debt was nearly $36 trillion.[1]

The One Big Beautiful Bill Act, signed into law on July 4, 2025, increased the debt ceiling by another $5 trillion to $41 trillion, roughly 75% the value of the entire U.S. stock markets. The U.S. is in a worsening debt spiral, whereby massive new debt is necessary to repay old debt. "The founder of the world's biggest hedge fund, Ray Dalio, believes that US borrowing is at a crossroads. On its current trajectory he estimates the US will soon be spending $10tn a year in loan and interest repayments."[2]

As of November 22, 2024, the debt of the United States exceeded $36 trillion.[3] "The last time the debt ceiling was reached, in January 2023, the figure stood at $31.4 trillion. Under a deal reached in June that same year, Congress suspended the debt ceiling until 1 January, 2025."[4]

Disingenuously, "The Fiscal Responsibility Act of 2023 suspended the debt ceiling through January 1, 2025, at which point the debt ceiling will be reinstated at the amount of debt outstanding on that date ...." [5] This way congressmen avoided approving a $5 trillion increase in the debt in merely 18 months.

Contents

2023

On Jan. 19, 2023, the U.S. Treasury "reached the debt limit of $31.4 trillion,"[6] which was set at that level when Congress increased it by $2.5 trillion as signed into law by President Joe Biden on Dec. 16, 2021.

House conservatives supported Speaker Kevin McCarthy's stance taken in his February 1, 2023, meeting at the White House with President Biden: no increase in the debt ceiling unless there is an agreement to reduce federal spending.[7]

On April 26, 2023, the House passed a Republican-led debt ceiling increase bill that would reportedly trim $4.8 trillion from the deficit,[8] but the Senate never passed this. The vote in the House was 217–215, with every Dem voting against this. As reported by RollCall, key elements of this bill included:[8]

- either increasing the debt limit by $1.5 trillion or extending it through March 2024.

- limiting discretionary spending for ten years, beginning with a $1.47 trillion maximum for fiscal 2024 with 1% annual growth for each of the next 9 years. This would initiate $131 billion reduction from current levels.

- Rescinding energy tax credit provisions from Dems' 2022 climate law, except preserving some biofuel provisions for the Midwest farmers.

- repealing unspent COVID-19 relief and unobligated IRS tax enforcement funds, plus unspent climate-related grant funding in the 2022 law.

- canceling Biden's forgiveness plan for student loans (which the U.S. Supreme Court seems likely to strike down anyway).

- expanding requirements to work in the Supplemental Nutrition Assistance Program and Temporary Assistance for Needy Families, while also imposing new regulations for beneficiaries of Medicaid.

- spurring domestic energy production while redoing permitting for infrastructure and revamping energy rules.

- establishment requirements for authorization by Congress prior to imposing new major regulatory schemes.

On May 1, 2023, Treasury Secretary Janet Yellen declared a deadline of June 1, 2023, to increase the debt ceiling or else the federal government would default on its obligations, which she later extended to June 5. Biden signed new legislation on June 3, to postpone this crisis until January 1, 2025.

Liberal hysteria and History

Liberals use hysteria each time to increase the debt limit again and again, which impoverishes future generations of Americans. In fact, the stock market rocketed much higher the following day as conservatives stood strong against wasteful government spending.[6]

According to the Constitution, the Congress must approve all borrowings on behalf of the United States. Before the 20th century, Congress approved all bond issuances separately and explicitly. With the introduction of the debt ceiling, the U.S. Treasury now had a line on which it could borrow as needed, without having to go back to Congress for borrowings under the ceiling. Raising the debt ceiling is not the same thing as spending more money, since spending is dictated by the Federal Budget, but it does allow the Federal Government to meet any existing financial obligations.

Components of the debt

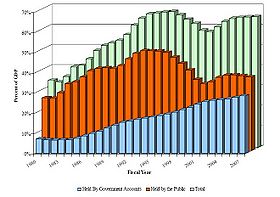

There are two components to the national debt: the debt held by the public, and intra-governmental debt. The former is defined as the debt held by any individual or entity that is not the federal government, such as a mutual fund, individual investor, foreign government, or a municipal government.[9] Intra-governmental debt is debt the government owes itself, such as the Social Security Trust Funds, the Medicare Hospital Insurance Trust Fund, and the Civil Service Retirement and Disability Fund.[9] The Thrift Savings Plan, the Federal Government's version of a 401(k) plan for employees, also holds special "G Fund" debt instruments; whenever the ceiling is reached without an increase, it is suspended from obtaining more of those instruments, but once a new ceiling is in place, it must then purchase them and pay interest in the interim.

Foreign governments, especially communist China, liberal institutional investors, insurance companies, and domestic governmental entities hold the vast majority of the US debt. Very little of it is owned by grassroots American investors.[10]

Obama debt ceiling crises

President Barack Obama voted against raising the debt ceiling in 2006. However, he later wanted to raise the debt ceiling to over twice its 2006 level. However, as Congress essentially deemed the Obama administration to be a serious credit risk, Obama did not get the debt ceiling increase he wanted. This is similar to a credit card company telling a person with either no income or little income who has maxed out on his credit card that he won't get a line increase and must pay off his card, lest he be sued. In fact, it is almost unheard of for a credit card company to give a credit line increase to someone who's maxed out on his credit card. But in February 2014, to avoid a public confrontation heavily weighted by the old media, many Congressional Republicans voted with Democrats to suspend the debt ceiling until March 2015 in hopes of winning back the Senate in November 2014.

The last increase in the debt ceiling occurred in February 2014 where the limit stood at $17.212 trillion. With large deficits emerging as baby boomers retire, some members of Congress expressed concern during the first debt ceiling crisis over the government's dependence on borrowing to meet its obligations. President Obama responded by creating the National Commission on Fiscal Responsibility and Reform (Simpson-Bowles Deficit Reduction Commission), which was charged with identifying “policies to improve the fiscal situation in the medium term and to achieve fiscal sustainability over the long run.”[11] However, President Obama promptly ignored the commission's recommendations.[12]

The prospect of the Obama administration defaulting on its debt rose greatly when the Democrats insisted on raising taxes to cover their irresponsible spending habits. Obama refused to engage in negotiations, much like a deadbeat who refuses to answer the phone when the creditors are calling. Unfortunately for the world, Obama's personal irresponsibility will hurt many honest hard working people who have done nothing wrong.

Background to first Obama debt crisis

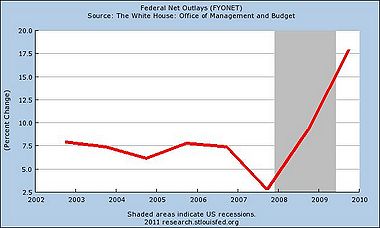

After the failure of President Obama's Stimulus package,[13] his entire White House economic team quit.[14][15] During the next few years, the deficit was projected to fall somewhat, but if discretionary spending were to stay at the same level, the deficit would not fall enough under President Obama's economic policies to stabilize debt payments. Further, the debt was projected to begin rising more rapidly under Obama's policy because of the rising costs of Social Security, Medicare, and Medicaid.

Unsustainability of Obama deficits -- 2011 debt ceiling standoff

As conceded in 2023 by liberal, government-funded NPR:

| “ | Obama made concessions on spending cuts in the end [in 2011], and so I think we might see a replay of that [in 2023]. I don't know how far Biden is willing to go. This caucus is even more radicalized than the caucus in 2011, so I think the situation [in 2023] is even more fraught than it was in 2011.[16] | ” |

In 2011, the Obama deficits were more than half the size of total private savings. Even before President Obama's massive increase in deficits, the national savings rate was insufficient to finance job creation (or "domestic private investment").[17] To sustain large deficits, the economy would require a combination of more private saving (less consumption), lower investment (less job creation), and higher borrowing from abroad. The unsustainability of deficits tends to be triggered rapidly, as no investor wants to be the one still holding the government debt when eventual default or hyperinflation occurs.[18]

In 2011, foreigners held $4.5 trillion (more than half) of the total privately held government debt. Foreigners are usually less willing to buy and hold government debt because they bear exchange-rate risk. Default or monetization typically leads to currency devaluation and would reduce the debt's value in foreign currencies. If foreigners were to become less willing to finance the U.S. Government's operations, significantly higher interest rates would have to be paid by Americans. Now that some foreign governments hold large portfolios of U.S. Government debt, any particular government would have the incentive to sell its holdings before everyone else if it believes that the debt has become unsustainable. Furthermore, if interest rates and the cost of carrying the debt were to rise suddenly, higher debt payments to foreigners would result in a fall in Americans personal income as wealth is transferred abroad.[19]

Leaving the deficit at an unsustainable size retains the risk that the budget could at some point enter a debt spiral, in which the U.S. Treasury rates rose sharply and suddenly. The direct effect of higher interest rates stemming from greater credit risk would be to reduce the value of existing government debt, as investors would be willing to pay a lower price (i.e., demand a higher rate of return) for Treasury securities to compensate for the greater credit risk. This would cause a negative “wealth effect” for debt holders, and debt holders would be expected to reduce their purchases. Since the publicly held debt reached $10 trillion at the end of FY2011, the wealth effect has become increasingly large. The most damaging wealth effects could come from financial institutions that hold U.S. Treasury securities. At the end of 2010, commercial banks held about $300 billion of U.S. Treasury securities, while insurance companies, Government Sponsored Entities (GSEs), and bond dealers held another $400 billion. As demonstrated during the financial crisis of 2008, financial firms “leveraged losses” can lead to a credit crunch that affects the economy as a whole.[20]

Aside from foreign buyers of U.S. Government debt, borrowing can only be financed through savings, and government borrowing competes with business borrowing to create jobs for the same pool of national savings. By increasing the demands on that pool of national savings, government borrowing pushes up the cost of all borrowing through higher interest rates, causing businesses to finance less capital spending and job creation than they otherwise would be able to. Less business borrowing for job creation, plant and equipment, and capital spending results in lower gross domestic product, and hence lower future national income, than would otherwise occur.[21]

History of the debt limit

The Second Liberty Bond Act of 1917, which helped finance the United States’ entry into World War I, allowed the U.S. Treasury to issue long-term Liberty Bonds marketed to the public to hold down the federal government's borrowing costs. The 1919 Victory Liberty Bond Act raised the maximum allowable federal debt to $43 billion, although the total outstanding federal debt at the time was only $25.5 billion.

In 1939, Congress eliminated separate limits on bonds and other types of debt, and created the first aggregate limit that covered nearly all public debt. This gave the Treasury freer rein to manage the federal debt as it saw fit. Thus, the Treasury could issue debt instruments with maturities that would reduce interest costs and minimize financial risks stemming from future interest rate changes. The debt limit then was $45 billion with total debt of $40.4 billion.

During World War II the debt ceiling was raised each year from 1941 through 1945, where it topped out at $300 billion. After the war, it was reduced to $275 billion. The Korean War was mostly financed by higher taxes rather than increased debt, and the limit remained at $275 billion until 1954. After 1954, the debt limit was reduced twice and increased seven times, until March 1962 when it again reached $300 billion, its level at the end of World War II.[22]

The United States debt ceiling has been raised approximately 84 times since the early 1900s. The table below gives details on the year, and the amount that the ceiling was raised. As seen below, many of the debt ceiling increases have been short term, contrary to Obama's position.

| Date | Amount of Debt | Sitting President | Date | Amount of Debt | Sitting President |

|---|---|---|---|---|---|

| December 1919 | $43.0 billion | Woodrow Wilson | September 1979 | $879.00 billion | Jimmy Carter |

| December 1939 | 45.0 billion | Franklin D. Roosevelt | June 1980 | 925.00 billion | Jimmy Carter |

| June 1940 | 49.0 billion | Franklin D. Roosevelt | December 1980 | 935.10 billion | Jimmy Carter |

| February 1941 | 65.0 billion | Franklin D. Roosevelt | February 1981 | 985.00 billion | Ronald W. Reagan |

| March 1942 | 125.0 billion | Franklin D. Roosevelt | September 1981 | 1.080 trillion | Ronald W. Reagan |

| April 1943 | 210.0 billion | Franklin D. Roosevelt | September 1981 | 999.80 billion | Ronald W. Reagan |

| June 1944 | 260.0 billion | Franklin D. Roosevelt | June 1982 | 1.143 trillion | Ronald W. Reagan |

| April 1945 | 300.0 billion | Harry S. Truman | September 1982 | 1.290 trillion | Ronald W. Reagan |

| June 1946 | 275.0 billion | Harry S. Truman | May 1983 | 1.389 trillion | Ronald W. Reagan |

| August 1954 | 281.0 billion | Dwight D. Eisenhower | November 1983 | 1.490 trillion | Ronald W. Reagan |

| July 1956 | 278.0 billion | Dwight D. Eisenhower | May 1984 | 1.520 trillion | Ronald W. Reagan |

| February 1958 | 280.0 billion | Dwight D. Eisenhower | July 1984 | 1.573 trillion | Ronald W. Reagan |

| September 1958 | 288.0 billion | Dwight D. Eisenhower | October 1984 | 1.824 trillion | Ronald W. Reagan |

| June 1959 | 295.0 billion | Dwight D. Eisenhower | November 1985 | 1.904 trillion | Ronald W. Reagan |

| June 1960 | 293.0 billion | Dwight D. Eisenhower | December 1985 | 2.079 trillion | Ronald W. Reagan |

| June 1961 | 298.0 billion | John F. Kennedy | August 1986 | 2.111 trillion | Ronald W. Reagan |

| March 1962 | 300.0 billion | John F. Kennedy | October 1986 | 2.300 trillion | Ronald W. Reagan |

| July 1962 | 308.0 billion | John F. Kennedy | July 1987 | 2.320 trillion | Ronald W. Reagan |

| May 1963 | 309.0 billion | John F. Kennedy | August 1987 | 2.352 trillion | Ronald W. Reagan |

| November 1963 | 315.0 billion | Lyndon B. Johnson | September 1987 | 2.800 trillion | Ronald W. Reagan |

| June 1964 | 324.0 billion | Lyndon B. Johnson | August 1989 | 2.870 trillion | George H. W. Bush |

| June 1965 | 328.0 billion | Lyndon B. Johnson | November 1989 | 3.123 trillion | George H. W. Bush |

| June 1966 | 330.0 billion | Lyndon B. Johnson | October 1990 | 3.230 trillion | George H. W. Bush |

| March 1967 | 336.0 billion | Lyndon B. Johnson | November 1990 | 4.145 trillion | George H. W. Bush |

| June 1967 | 358.0 billion | Lyndon B. Johnson | April 1993 | 4.370 trillion | Bill Clinton |

| April 1969 | 377.0 billion | Richard M. Nixon | August 1993 | 4.900 trillion | Bill Clinton |

| June 1970 | 395.0 billion | Richard M. Nixon | March 1996 | 5.500 trillion | Bill Clinton |

| March 1971 | 430.0 billion | Richard M. Nixon | August 1997 | 5.950 trillion | Bill Clinton |

| March 1972 | 450.0 billion | Richard M. Nixon | June 2002 | 6.400 trillion | George W. Bush |

| October 1972 | 465.0 billion | Richard M. Nixon | May 2003 | 7.384 trillion | George W. Bush |

| December 1973 | 475.7 billion | Richard M. Nixon | November 2004 | 8.184 trillion | George W. Bush |

| June 1974 | 495.0 billion | Gerald Ford | March 2006 | 8.965 trillion | George W. Bush |

| February 1975 | 577.0 billion | Gerald Ford | September 2007 | 9.815 trillion | George W. Bush |

| November 1975 | 595.0 billion | Gerald Ford | July 2008 | 10.615 trillion | George W. Bush |

| March 1976 | 627.0 billion | Gerald Ford | October 2008 | 11.315 trillion | George W. Bush |

| June 1976 | 700.0 billion | Gerald Ford | February 2009 | 12.104 trillion | Barack Obama |

| October 1977 | 752.0 billion | Jimmy Carter | December 2009 | 12.394 trillion | Barack Obama |

| August 1978 | 798.0 billion | Jimmy Carter | February 2010 | 14.294 trillion | Barack Obama |

| April 1979 | 830.0 billion | Jimmy Carter | August 2011 | 14.694 trillion | Barack Obama |

| September 2011 | 15.194 trillion | Barack Obama | |||

| January 2012 | 16.394 trillion | Barack Obama | |||

| February 2013 | No limit | Barack Obama | |||

| May 2013 | 16.737 trillion | Barack Obama | |||

| October 2013 | No limit | Barack Obama | |||

| February 2014 | 17.212 trillion | Barack Obama | |||

| February 2014 | No limit till Mar '15 | Barack Obama |

See also

External links

- The Debt Limit:History and Recent Increases.

- Bureau of the Public Debt

- Public Debt to the Penny

- Department of the Treasury

References

- ↑ https://www.yahoo.com/finance/news/us-debt-now-37trn-worried-212745718.html

- ↑ Simon Jack, BBC Business Editor, "US debt is now $37tn – should we be worried?" (July 5, 2025).

- ↑ https://www.pgpf.org/article/the-national-debt-is-now-more-than-36-trillion-what-does-that-mean/

- ↑ https://www.bbc.com/news/articles/cr4r3rped5qo

- ↑ https://www.americanactionforum.org/insight/the-debt-ceiling-a-refresher/

- ↑ 6.0 6.1 https://www.cbsnews.com/news/debt-limit-ceiling-impact-on-your-finances-social-security-medicare-401k/

- ↑ https://fortune.com/2023/02/02/mccarthy-biden-meeting-debt-ceiling-hour-default-white-house/

- ↑ 8.0 8.1 https://rollcall.com/2023/04/26/house-passes-1-5-trillion-debt-limit-increase-spending-cuts/

- ↑ 9.0 9.1 http://www.concordcoalition.org/issue-briefs/2011/0708/understanding-federal-debt-limit

- ↑ https://www.pgpf.org/blog/2022/09/the-federal-government-has-borrowed-trillions-but-who-owns-all-that-debt

- ↑ National Commission on Fiscal Responsibility and Reform, retrieved from http://www.fiscalcommission.gov , July 28, 2011.

- ↑ http://www.realclearpolitics.com/2011/06/23/cbo_quotwe_don039t_estimate_speechesquot_258038.html

- ↑ Obama’s Failure of Leadership, Eleanor Clift, Newsweek, 10/4/10.

- ↑ Summers latest member of Obama economic team to quit

- ↑ http://www.dailyfinance.com/2010/11/23/two-white-house-economic-advisers-to-quit/ More White House Economic Advisers to Step Down

- ↑ https://www.npr.org/2023/04/28/1172684217/debt-ceiling-bill-mccarthy-biden-leverage

- ↑ The Sustainability of the Federal Budget, Congressional Research Service, June 28, 2011, p. 2 pdf.

- ↑ The Sustainability of the Federal Budget, Congressional Research Service, June 28, 2011, p. 5 pdf.

- ↑ The Sustainability of the Federal Budget, Congressional Research Service, June 28, 2011, p. 10 pdf.

- ↑ The Sustainability of the Federal Budget, Congressional Research Service, June 28, 2011, pp. 11-12 pdf.

- ↑ The Sustainability of the Federal Budget, Congressional Research Service, June 28, 2011, p. 16 pdf.

- ↑ The Debt Limit: History and Recent Increases, Congressional Research Service, July 1, 2011, pdf pps. 9-10.

- ↑ http://usgovinfo.about.com/od/federalbudgetprocess/a/US-Debt-Ceiling-History.htm