Stock market

A stock market is a list of stocks, or jointly held and publicly traded shares of a corporations.[1] The stocks usually bear some relation to each other: for example, in America, the Dow Jones Industrial Average is a list of longtime successful American companies (despite its name very few of the current companies are actually industrial), whereas the Nasdaq consists mostly of technology-based stocks. Other major cities in industrailized countries have stock exchanges, including "London, Paris, Milan, Hong Kong, Toronto and Tokyo."[2]

Market capitalization is the amount a company is worth in its publicly trade stock, and a ranking of the companies having the highest capitalization is easily accessible.[3] The total market capitalization of all the publicly traded stocks in the United States, including the New York Stock Exchange and NASDAQ, was about $41 trillion as of December 31, 2022. That total stock market value is not much larger than the national debt, which was nearly $32 trillion as of March 10, 2023.[4]

Stocks trade as futures after the markets close, which can be indicative of how they will open the following morning.[5]

Contents

- 1 Value investing

- 2 Growth investing

- 3 Tech investing

- 4 Standard and Poor's 500

- 5 Dow Jones Industrial Average

- 6 Notable stock investment tools/sources/specialists

- 7 Beginner's guides on stock investing

- 8 Stock investing vs. real estate investing

- 9 Books on stock investing

- 10 See also

- 11 Further reading

- 12 References

Value investing

See also: Value investing

According to Investopedia: "Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors actively ferret out stocks they think the stock market is underestimating."[6]

Articles on value investing

- Value Investing Definition, How It Works, Strategies, Risks, Investopedia

- The Value Investing Strategy, Motley Fool

- Strategies of Legendary Value Investors, Investopedia

- What Is Value Investing?, Nerd Wallet

Growth investing

See also: Growth investing

According to Bankrate.com: "Growth investing is a popular investment strategy that has been used by investors for decades. It involves buying and holding stocks of companies with the potential for above-average earnings growth. These companies may be part of fast-growing industries and are often high-risk, high-reward investments."[7] Investopedia defines growth investing in the following manner: "Growth investing is a stock-buying strategy that aims to profit from firms that grow at above-average rates compared to their industry or the market.[8]

Articles on growth investing

- What is growth investing?, Bankrate.com

- Growth Investing: Overview of the Investing Strategy, Investopedia.com

- What Is Growth Investing And 8 Best Strategies, Forbes, 2023

- Growth vs Value Investing: Which Is Best For You?, Forbes, 2023

Tech investing

See also: Technology

- A Primer on Investing in the Tech Industry, Investopedia

- How To Invest In Tech Stocks: What You Need To Know, Forbes, 2023

- How To Start Investing in Tech Startups, Harvard Business School

- Investing in tech stocks: Is now a good time?, U.S. Bank

- Investing in the tech sector? Here’s what you need to know, J.P. Morgan Wealth Management

Standard and Poor's 500

The Standard and Poor's 500 (commonly called the S&P 500) is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

The Standard and Poor's 500 (commonly called the S&P 500) is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

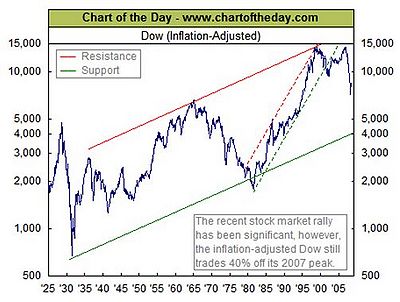

Dow Jones Industrial Average

The Dow Jones Industrial Average (commonly called Dow Jones or simply the Dow) is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

Notable stock investment tools/sources/specialists

- The Motley Fool – Best Stock-Picking Service

- Morningstar – Best Data-Driven Investment Research Platform (especially for mutual funds and ETFs)

- Zacks – Best Supplementary Rating System

- Seeking Alpha – Best Investment Research Website for Experienced Investors

Motley Fool:

We Study Billionaires:

- We Study Billionaires - YouTube. We Study Billionaires is the world's largest stock investing podcast show with 150,000,000+ downloads.

Beginner's guides on stock investing

What is the stock market and how it works

- What Is the Stock Market and How Does It Work?, Investopedia

- What Is the Stock Market?, Nerd Wallet

- How Does the Stock Market Work?, Investopedia

- What Is the Stock Market & How Does It Work?, Motley Fool

Beginner's guides on stock investing

- How to Invest in Stocks: A Beginner’s Guide, Investopedia

- Stock market basics: 9 tips for beginners, Bankrate.com

- Stock Market Basics: What Beginner Investors Should Know, Nerd Wallet

- A beginner’s guide to investing in the stock market, Fortune, 2024

Stock investing vs. real estate investing

- Has Real Estate or the Stock Market Performed Better Historically?, Investopedia, 2023

- Real Estate vs. Stocks: Which Is the Better Investment?, Nerd Wallet, 2023

- Real Estate vs. Stocks: Which Has Higher Returns?, U.S. News & World Report, 2023

Books on stock investing

See also: Books on stock investing

Below is a list of classic and best selling books on stock investing/investing:

- Unbreakable Investor by Charles Payne. Paradigm Direct, LLC (January 1, 2023)

- The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns (Little Books, Big Profits) by John C. Bogle. Wiley; 10th Anniversary, Revised, Updated ed. edition (October 16, 2017)

- Value Investing: From Graham to Buffett and Beyond (Wiley Finance) by Bruce C. Greenwald, Judd Kahn, Erin Bellissimo and Mark A. Cooper. John Wiley & Sons Inc; 2nd edition (November 17, 2020)

- The Intelligent Investor by Benjamin Graham. Generic (1949).

- Investing for Growth: How to make money by only buying the best companies in the world – An anthology of investment writing, 2010–20 by Terry Smith. Harriman House (October 27, 2020)

- The Quality Growth Investor - 2024 Edition: The Ultimate Playbook For Quality Growth Investing by Long Equity. Independently published (November 11, 2023)

- Benjamin Graham and the Power of Growth Stocks: Lost Growth Stock Strategies from the Father of Value Investing by Frederick K. Martin, Nick Hansen, Scott Link and Rob Nicoski. McGraw Hill; 1st edition (November 14, 2011)

- John Bogle on Investing by John Bogle. Wiley; 1st edition (April 17, 2015)

- The Bogleheads' Guide to the Three-Fund Portfolio: How a Simple Portfolio of Three Total Market Index Funds Outperforms Most Investors With Less Risk by Taylor Larimore. John Wiley & Sons Inc; 1st edition (July 3, 2018)

- The Bogleheads' Guide to Investing: Second Edition by Mel Lindauer, Taylor Larimore and Michael Leboeuf. John Wiley & Sons Inc; 2nd edition (August 18, 2014)

- The Most Important Thing: Uncommon Sense for the Thoughtful Investor by Howard Marks. Columbia Business School Publishing; Illustrated edition (May 1, 2011)

- How to Make Money in Stocks: A Winning System in Good Times and Bad by William J. O'Neil. McGraw Hill; 4th edition (June 8, 2009)

- A Gift to My Children: A Father's Lessons for Life and Investing by Jim Rogers. Random House (April 28, 2009)

- Street Smarts: Adventures on the Road and in the Markets by Jim Rogers. Currency; First Edition (February 5, 2013)

- Adventure Capitalist: The Ultimate Investor's Road Trip by Jim Rogers. Random House; 1st edition (May 13, 2003)

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market by Peter Lynch. Simon & Schuster; 2nd edition (April 3, 2000)

- Beating the Street by Peter Lynch. Simon & Schuster; Revised edition (May 25, 1994).

- Lies Your Broker Tells You: What to Watch for and Still Achieve Financial Security by Thomas D. Saler. Walker & Co; First Edition (January 1, 1989)

See also

Analytic services relating to stock investing:

Further reading

- Fraser, Steve. Wall Street: America's Dream Palace (2009) excerpt and text search

References

- ↑ Harvey, Campbell R. (2011). Stock Market. Financial Glossary. NASDAQ. Retrieved on 30 October 2014.

- ↑ What Is A Stock Exchange And What Does It Do?. SES (2014). Retrieved on 30 October 2014. “Most of the world’s industrialized nations have one or more stock exchanges. Among the largest are those in London, Paris, Milan, Hong Kong, Toronto and Tokyo.”

- ↑ https://companiesmarketcap.com/

- ↑ https://www.usdebtclock.org/

- ↑ https://www.marketwatch.com/

- ↑ Value Investing Definition, How It Works, Strategies, Risks

- ↑ What is growth investing?, Bankrate.com

- ↑ Growth Investing: Overview of the Investing Strategy, Investopedia.com