Essay: Russia's economy and gas and oil profits will be BADLY damaged when China's economy declines

Russia's economy is not highly diversified. It is too dependent on oil and gas.[1]

That’s according to Bloomberg Economics, which now forecasts it will take until the mid-2040s for China’s gross domestic product to exceed that of the US — and even then, it will happen by “only a small margin” before “falling back behind.”

Before the pandemic, they expected China to take and hold pole position as early as the start of next decade.[2]

See: Skepticism about China remaining a global power

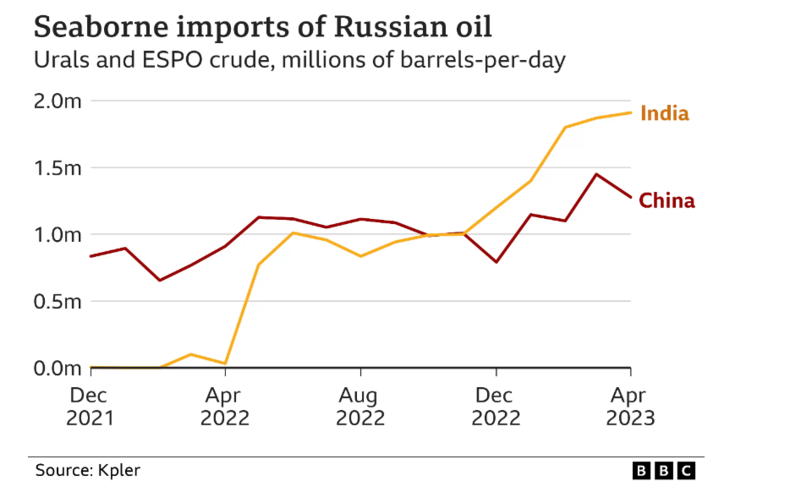

Key point: The biggest challenge to the Russian oil price cap sanctions is India and China buying Russian oil. Therefore, a big drop in the Chinese economy will make the effectiveness of these sanctions much more effective. Currently, the Chinese economy is experiencing a number of big difficulties and could see a big decline (See: Skepticism about China remaining a global power).

For more information, please see: The war in Ukraine and Western sanctions will significantly hurt the Russian economy

China is currently experiencing large economic problems. See: Skepticism about China remaining a global power

Contents

- 1 Chinese real estate crisis (2020–present)

- 2 Chinese stock market meltdown starting in 2021

- 3 Youth unemployment in China

- 4 Why I am not bullish on Russia's future

- 5 Russia's economy is not highly diversified. It is too dependent on oil and gas

- 6 Russian oil: Lower future production and lower future profits due to future higher extraction costs and other inefficiencies

- 7 The USA is outproducing Russia and Saudi Arabia in oil production. The best is yet to come

- 8 The myth of multipolarity: American power’s staying power. What do the terms unipolar, bipolar and multipolar mean as far as international relations?

- 8.1 John Joseph Mearsheimer and U.S. relations with China and Russia

- 8.2 2018 Pew Research survey: Most countries saw the United States as the world’s leading economic power rather than China. Most countries preferred the United States as the world’s leading economic power rather than China as well

- 8.3 Brand Finance's 2022 ranking of the countries with the most soft power: USA ranked #1. The UK, one of the strongest allies of the USA, is ranked #2

- 9 The rubble is turning to rubble

- 10 Vladimir Putin's choice to invade Ukraine in February 2022 was a terrible decision

- 11 User Conservative's international politics essays

- 12 Other User: Conservative essays

- 13 See also

- 14 External links

- 15 References

Chinese real estate crisis (2020–present)

See also: Chinese real estate crisis (2020–present)

After China's real estate developer giant Evergrande defaulted on its offshore debt in December 2021, it sent shockwaves through the Chinese economy.[4] The bursting of China's bubble economy began in earnest in December of 2021. Since 2021, China’s stock markets have lost about $7 trillion in value (See: Chinese stock markets).[5]

China now has a struggling economy (See: It's time to be very bearish about China's long-term economy

On February 6, 2023, Yahoo Finance said concerning the Chinese real estate crisis (2020–present):

| “ | China's overreliance on real estate has sent its economy tumbling toward 2008-era financial conditions, Kyle Bass told CNBC on Tuesday.

"This is just like the US financial crisis on steroids," the Hayman Capital founder said. "They have three and a half times more banking leverage than we did going into the crisis. And they've only been at this banking thing for a couple of decades." The years of double-digit growth China enjoyed prior to the pandemic were made possible by an unregulated real estate market, Bass noted, which leaned too heavily on debt to expand. With defaults now plaguing the industry, this spells massive trouble for the country's broader economy. The real estate sector makes up around a quarter of the country's GDP and 70% of household wealth. "The basic architecture of the Chinese economy is broken," Bass summarized.[6] |

” |

In December 2023, Nikkei Asia reported:

| “ | If the Chinese real estate bubble bursts and triggers a financial crisis, the nation's economic growth will be stuck at around 1%, jeopardizing its goal of doubling gross domestic product by 2035, the Japan Center for Economic Research says in a new report.

The report projects GDP growth for 18 Asia-Pacific countries and regions through 2035, with annual updates made to reflect the latest policies and economic conditions. The JCER released a summary of this year's report Monday. China's economy has been dragged down by property market woes for more than two years. The government's plans to strengthen financial support for real estate companies could place an excessive burden on the financial system. Mishandling the response could wreak havoc. Sluggish condominium sales and plunging prices could significantly push up defaults on bank loans, resulting in widespread financial woes at small and midsize banks.[7] |

” |

Articles and videos: Chinese real estate crisis (2020–present)

- China’s Real Estate Crisis, Shown in Two Charts, Visual Capitalist, 2024

- China’s middle class battered by real-estate meltdown—and it might be just ‘the beginning of more wealth losses’, Fortune, December 17, 2023

- China's real estate slump shatters myth of ever-rising prices, Nikkei Asia, December 2023

Videos:

- China's embattled property sector could take years to recover, CNA news network, 2024

- Evergrande Crisis: China Property Giant's Liquidation Order Can Cause Meltdown Of China's Economy?, India Today, 2024

- Evergrande liquidation: A warning sign for the future of Chinese Real Estate and Economy, Economic Times, 2024

Chinese stock market meltdown starting in 2021

See also: Chinese stock markets

Since 2021, China’s stock markets have lost about $7 trillion in value.[9]

Videos of Chinese stock market meltdown:

- Xi Jinping Scrambles to Overturn China’s $6 Trillion Stock Market Rout, FirstPost, 2024

- Chinese stocks under pressure as investors lose confidence in the economy, Yahoo Finance, 2024

- Can China save its stock market?, New Zealand Herald, 2024

Youth unemployment in China

See also: Youth unemployment in China

On February 14, 2023, Yahoo Finance reported about youth unemployment in China:

| “ | China's youth unemployment rate is once again available to the world, after a six-month blackout period where no new figures were published. Joblessness looks to have dropped considerably since the data was last released in June.

But the new figure isn't exactly comparable to previous months — it now excludes full-time students from the calculation. On its face value, youth unemployment in December stood at 14.9%, whereas it touched 21.3% in the summer. Back then, the high-flying number was a focal point for economists, highlighting emerging challenges resulting from China's slowing economy. As fresh graduates poured into the nation's workforce, they faced stagnating industries with a weaker demand for labor. These realities may still hold true, even if the revised methodology provides a smaller number, Nicole Goldin, a nonresident senior fellow at the Atlantic Council, wrote. "The lower result though, is still about three times the overall unemployment rate in China (5.1 percent) and reflects the quandary facing young people there. (For comparison, the OECD average is 10.5 percent.)," she wrote in a Friday post. While headwinds to youth unemployment aren't exclusive to China, the country is mired in broader economic turmoil, from slowing consumption, a debt-burdened property sector, and a stock market in free-fall.[10] |

” |

Why I am not bullish on Russia's future

See also: Why I am not bullish on Russia's future

For multiple reasons, I am not bullish on Russia's future. See: Why I am not bullish on Russia's future

One of the reasons is that Russia has too many eggs in the sell oil and gas to the China basket as can be seen in the data given in the remainder of this essay.

Oil and gas are a significant part of the Russian economy.

There are definite signs that China's economy faces a decline in the future (See: Skepticism about China remaining a global power).

Over time, Chinese economic decline is Russia’s decline:

Before the outbreak of Russia's invasion of Ukraine, China promised to back Russia “eternally”.

Key point:

Given China's major problems, it is just a matter of time before they surface to a greater and greater degree. So the question is not if China faces VERY big economic problems, but when. And when that day arrives, Russia's economy and gas and oil profits will be BADLY damaged when China's economy declines. Right now, Russia is focusing on their war economy due to the war in Ukraine. So the important work of diversifying its economy is not occurring to the extent it should.

Furthermore, the war in Ukraine is making Russia's demographic crisis worse as can be seen by the resources given below so it will have less labor and less brain power to solve this problem.

War in Ukraine causing Russia's demographic crisis worse:

- Russia Facing Population Disaster - Demographic Crisis, Employee Shortages & Economic Crisis

- Russia stares into population abyss as Putin sends its young men to die, The Telegraph, February 2023

- Millennials and Gen Z are blaming Putin for intensifying Russia’s baby shortfall: ‘It’s pretty bad for us’, Fortune magazine, December 3, 2022

- Dramatic Population Drop in Russia, as War, COVID and Emigration Exacerbate Declining Births, 6/03/2023

Russia is experiencing a brain drain:

- Russia's economy faces a 'massive brain drain' as over 1 million young workers exit labor force, Markets Insider, 2023

- The Great Russian Brain Drain, Novaya Gazeta Europe, 2023

- As Russia sees tech brain drain, other nations hope to gain, Associated Press, 2022

Russia's economy is not highly diversified. It is too dependent on oil and gas

Oil and gas are a significant part of the Russian economy. Russia is now selling oil and gas at a lower profit margin to China/India due to sanctions and Europe moving away from Russia oil/gas:

Oil and gas are a significant part of the Russian economy. Russia is now selling oil and gas at a lower profit margin to China/India due to sanctions and Europe moving away from Russia oil/gas. China's economy is having significant problems compared to its past. If China's economy gets worse (And there is some evidence that China's future economy will may worse this decade and beyond), that is going to hurt the Russian economy. See: Essay:Skepticism about China remaining a global power).

Newsweek's November 23, 2023 article Russian Economy About to 'Hit the Ice,' Putin Ally Warns states:

| “ | Russia's economy is about to "hit the ice", billionaire businessman Oleg Deripaska, described as President Vladimir Putin's "favorite oligarch", has warned.

The businessman, whose fortune Forbes estimates at $2.4 billion, issued the warning in a post on his Telegram channel, saying that there is a general drop in commodity prices, including those that Russia exports, and that this could negatively impact the country's economy... Deripaska warned that next year's budget could be short 10–12 trillion rubles ($112.8 to $135.36 billion) due to the current drop in commodity prices. This could be caused by a general decline in global prices for raw materials, "suppressed economic growth," and "the tyranny of state capitalism, raising prices for all its products and services, drawing subsidies and subsidies from the budget," the oligarch said. He said the current situation is a "trap", and it is only possible to get out of this through "serious economic changes, for which, apparently, there is no will yet." "What the world calls a 'soft landing' continues, prices for all commodities are declining. And we have a record tax collection this year of 46 trillion rubles. Already in the next year the income situation [government revenues] will hit the ice," he added. The IMF forecasts that the Russian economy will grow by 2.2 percent this year after shrinking by 2.1 percent last year, though it sees GDP growth slowing to 1.1 percent in 2024.[12] |

” |

In addition, please see: The war in Ukraine and Western sanctions will significantly hurt the Russian economy

"Even the act of diverting supplies to Asia entails a significant reduction in Russian companies’ profit margins. It costs a lot more to transport oil to Asian markets than to Europe, and there is not much spare transport capacity, which pushes up the cost of freight, reducing the profit made by Russian companies, whatever the amount at which the price is capped.

The price cap also enables Asian buyers to obtain big discounts on Russian oil. China and India may not officially be enforcing the cap, but it’s hard to imagine that companies from those countries will not use it to barter the price down. Indeed, this is already happening: some shipments to China due to be loaded onto tankers in January were sold at $5–6 cheaper per barrel than usual."[13]

Russia is now selling oil and gas at a lower profit margin to China/India due to sanctions and Europe moving away from Russia oil/gas.[14]

Trump has Putin ‘over a barrel’ with aggressive energy policy, defense of the West, CNBC, 2017

It is just a matter of time before another Republican president will be elected in the USA.

Unfortunately for Russia, it does not have a well-diversified economy.

Countries with diversified economies are more resilient and stable

There are definite signs that China's economy faces a decline in the future (See: Skepticism about China remaining a global power

Russia has too many eggs in the sell oil and gas to the China basket.

Booz & Company was a global strategy consulting team established in the United States in 1914. The firm was acquired by PwC on April 4, 2014.

Below is the executive summary of their report entitled Resilient, stable, sustainable: The benefits of economic diversification

| “ | The effects of the recent global economic crisis were allpervasive, and demonstrated that no economy is safe from destabilizing external events. Resource-dependent countries, with their narrow base of economic activity, are particularly vulnerable, but all countries may have vulnerabilities stemming from a lack of diversification in one or more economic dimensions, and they must be more vigilant in managing risks to their economies. Not only must a country’s gross domestic product (GDP) be balanced among sectors, but key elements of its economy must be varied, flexible, and readily applicable to a variety of economic opportunities, and areas of overconcentration must continually be identified and mitigated. Policymakers should work to achieve greater economic diversification, in order to reduce the impact of external events and foster more robust, resilient growth over the long term.

For resource-rich, developing economies, the immediate imperative is to diversify export-oriented sectors, but for the benefit of long-term sustainability, they must also look at the larger picture. A strong institutional and regulatory framework and workforce development initiatives are indispensable to the diversification effort; and proper management of human capital is key, especially in those countries experiencing a “demographic dividend.” Implementing such comprehensive diversification and risk management strategies won’t be easy, but the result—a diverse, stable, and growing economy—is worth the effort.[18] |

” |

Related articles:

Russian oil: Lower future production and lower future profits due to future higher extraction costs and other inefficiencies

- The Golden Age of Russian Oil Nears an End

- The Future of Russian Oil Production in the Short, Medium, and Long Term, Abstract

- How Stable Is the Russian Oil Industry? - Video

- Analysts Predict 42% Decline In Russian Oil Production By 2035

- Russian Oil's Vanishing Act - video

- Crumbling Infrastructure in the Russian Taiga - video

- A long-term outlook on Russian oil industry facing internal and external challenges

The USA is outproducing Russia and Saudi Arabia in oil production. The best is yet to come

See also: Essay: The USA is outproducing Russia and Saudi Arabia in oil production. The best is yet to come

For more information, please see: The USA is outproducing Russia and Saudi Arabia in oil production. The best is yet to come

The myth of multipolarity: American power’s staying power. What do the terms unipolar, bipolar and multipolar mean as far as international relations?

See also: Essay: The myth of multipolarity. What do the terms unipolar, bipolar and multipolar mean as far as international relations? and Essay: Western, liberal dominance over the world is over

As far international relations, the education website Unacademy.com defines a unipolar world thusly, "A unipolar world is when the majority of the world is dominated by a single state or nation's military and economic power and social and cultural influence."

The military defeats of the Soviet Union and United States in Afghanistan and the Vietnam War help demonstrate that we don't live in a unipolar world. It is hard to be an occupier in a country that doesn't want you to be there - especially in an age of fourth generation warfare (Fourth generation warfare is warfare where there is a blurring of the separation between war/politics and combatants/civilians. 4GW wars are more decentralized in terms of their command and control). See also: Essay: Western, liberal dominance over the world is over

A multipolar world refers to a system in the world which power is distributed among multiple/many states or blocs of states, rather than being concentrated in one (unipolar) or two (bipolar) dominant powers.[22]

The material below argues that the world is not presently multipolar.

- The Myth of Multipolarity, American Power’s Staying Power, Foreign Affairs, 2023

- The multipolarity thesis: the verdict of Unhedged and Chartbook, Financial Times, October 12, 2023

- No, the World Is Not Multipolar, Foreign Affairs, September 22, 2023

- Multipolarity: What Is It Good For? (Discussion of the above Foreign Affairs article The Myth of Multipolarity, 2023)

However, a number of leading international political analysts are skeptical about China remaining a global power as it faces a number of serious intractable problems (See: Skepticism about China remaining a global power).

I do agree with Donald Trump that America should not get into "endless wars" that do not serve America's vital interests.[23] I also agree with Trump's policy of not using the American military to "solve ancient conflicts in faraway lands".[24]

A great strength of the United States is its very consistent growth of its GNP over decades and its quick recovery the few times its GNP has gone down.[25]

In addition, research indicates that in the long-term, non-authoritarian countries are more likely to experience greater economic growth. See: Time Under Authoritarian Rule and Economic Growth, CORI Working Paper No. 2007-02

For more information on this topic, please see:

*Should You Be Bullish on America?

Why is America so rich?

*Size of a working age population in a country and its correlation with national GNP in advanced economies. The ability of the United States to attract some of the best and brightest workers in the world

*Slow and steady growth over the long term via capitalism and the rule of law versus short-sighted authoritarian economic growth that is costly to the long term economy

According to Yahoo Finance: "According to Yahoo Finance: "Efficiency in production, also coined as productivity, is one of the major driving forces behind economic resilience in a country... The United States has one of the strongest economies in the world. The country hosts some of the largest companies in the world, which contributes to the high GDP per capita in the country."[27]

As can be seen in the map above, the USA has one of the highest labor productivity rates in the world and it is significantly higher than both China and Russia.[28]

See also: The USA has one of the highest labor productivity rates in the world - significantly higher than both China and Russia

Read the articles: The Importance Of A Diversified Economy and Resilient, stable, sustainable: The benefits of economic diversification

Estimates of Russian GNP 1991 to August 2023 measured in US fiat dollars; exchange rates between the dollar and the ruble ended in March 2022 when the ruble became a gold-backed currency.

Recently, the Russian ruble has seen a big decline:

*Russia’s War-Torn Economy Hits Its Speed Limit: Economists see this week’s currency gyrations not as the beginning of a financial crisis but rather as a symptom of the Kremlin’s sclerotic economic prospects, Wall Street Journal, August 2023

*The Russian ruble hit a 16-month low this week and is one of the worst performing currencies in 2023, August, 2023

*Russia Cranks Interest Rates to 12% in Emergency Move Supporting Ruble, Barron's, August 2023

*5 stats show how Russia's economy is declining, Business Insider, 2023

John Joseph Mearsheimer and U.S. relations with China and Russia

John Joseph Mearsheimer, is an American political scientist and international relations scholar, who belongs to the realist school of international relations and teaches at the University of Chicago.

In his 2023 interview the South China Post, Professor John Joseph Mearsheimer stated about U.S. relations with China and Russia:

| “ | The Americans have a vested interest in pivoting full force to East Asia, to contain China. The Americans view China as a more serious threat than Russia. It’s very important to understand that China is a peer competitor to the United States. China is a rising great power and is a threat to the US in ways that Russia is not. So the Americans have a vested interest in not getting bogged down in a war in eastern Europe, more specifically in Ukraine.

Furthermore, they have a vested interest in doing everything they can to make sure that Russia and China are not close allies. What happens as a result of the Ukraine war is that it’s almost impossible for the US to fully pivot in Asia.[30] |

” |

In his March 2022 interview with The New Yorker, Mearsheimer indicated:

| “ | I’m talking about the raw-power potential of Russia—the amount of economic might it has. Military might is built on economic might. You need an economic foundation to build a really powerful military. To go out and conquer countries like Ukraine and the Baltic states and to re-create the former Soviet Union or re-create the former Soviet Empire in Eastern Europe would require a massive army, and that would require an economic foundation that contemporary Russia does not come close to having. There is no reason to fear that Russia is going to be a regional hegemony in Europe. Russia is not a serious threat to the United States. We do face a serious threat in the international system. We face a peer competitor. And that’s China. Our policy in Eastern Europe is undermining our ability to deal with the most dangerous threat that we face today.[31] | ” |

2018 Pew Research survey: Most countries saw the United States as the world’s leading economic power rather than China. Most countries preferred the United States as the world’s leading economic power rather than China as well

- More countries see U.S. as top global economy over China in post-COVID reversal, Axios, June 27, 2023

Brand Finance's 2022 ranking of the countries with the most soft power: USA ranked #1. The UK, one of the strongest allies of the USA, is ranked #2

Soft power is a nation's capacity to cause others to do things through persuasive/non-coercive means. The American political scientist Joseph Nye introduced the concept of "soft power" in the late 1980s.

Brand Finance, the world's leading brand valuation consultancy, annually list the countries with the strongest soft power.

Brand Finance's 2022 ranking of the 10 countries with the most soft power[32]:

- United States

- United Kingdom (One of the strongest allies of the United States)

- Germany

- China

- Japan

- France

- Canada

- Switzerland

- Russia

- Italy

The rubble is turning to rubble

Recently, the Russian ruble has seen a big decline:

*Russia’s War-Torn Economy Hits Its Speed Limit: Economists see this week’s currency gyrations not as the beginning of a financial crisis but rather as a symptom of the Kremlin’s sclerotic economic prospects, Wall Street Journal, August 2023

*The Russian ruble hit a 16-month low this week and is one of the worst performing currencies in 2023, August, 2023

*Russia Cranks Interest Rates to 12% in Emergency Move Supporting Ruble, Barron's, August 2023

*5 stats show how Russia's economy is declining, Business Insider, 2023

Vladimir Putin's choice to invade Ukraine in February 2022 was a terrible decision

"When are you going to go home, Vladimir Putin? For the Love of God, stop killing Ukrainians in their Home Country and go back to your own Home, i.e. Russia." - NishantXavierFor Christ the King 10:03, August 25, 2023 (EDT)

As can be seen in the above essay, two areas that Russia has been hurt is in Russian blood and in the Russian pocketbook. The damage is not through happening.

User Conservative's international politics essays

General

- The myth of multipolarity. What do the terms unipolar, bipolar and multipolar mean as far as international relations?

- What drives Xi Jinping and Vladimir Putin?

- The anti-Christianity Mao Zedong, Fidel Castro, Joseph Stalin and Xi Jinping have opposed homosexuality so this isn't a very high moral bar for China and Russia to clear

- Why has the West been so successful?

The United States

- The United States will be the leading power in the world for the foreseeable future

- Is the USA an economic powerhouse and juggernaut?

- Size of a working age population in a country and its correlation with national GNP in advanced economies. The ability of the United States to attract some of the best and brightest workers in the world

- Top 12 reasons why people are flocking to the USA and leaving the corrupt, authoritarian countries of China and Russia

- The USA is outproducing Russia and Saudi Arabia in oil production. The best is yet to come

- The USA can reduce its national debt. It has done it before

- The citizens of the United States are happier than the citizens of Russia and China. USA! USA! USA!

- The U.S. Navy is the most powerful navy in the world

- Gold reserves by country. The USA is still golden!

- The USA will become bigger, better and stronger than ever before! Russia and China will not! USA! USA! USA! - Humor

China

Russia

War in Ukraine

- How long will the war in Ukraine last and what will its likely outcomes will be? A prediction on its outcomes

- The SPECIFIC MONTH OF APRIL 2022 was not a pivotal point in politics that will affect politics for 30 years

Other User: Conservative essays

See also

Essays:

External links

- Oil Prices Fall as China Fails to Impress Markets With Growth Pledge, OilPrice.com, March 5, 2024

- Russia’s Dependence on China May Not Be Enough to Save Economy, The Jamestown Foundation, February 8, 2024

- China's economic slump is nowhere near the bottom, says Oxford Economics, CNBC

- '10 years left': This famed geopolitical analyst says China will collapse in the next decade — here are 3 key numbers that could support his contrarian forecast, Yahoo News, April 12, 2023

References

- ↑ Diversifying Russia, European Bank

- ↑ China Slowdown Means It May Never Overtake US Economy, Forecast Shows, Bloomberg News, September 5, 2023

- ↑ Who is Still Buying Russian Fossil Fuels in 2023

- ↑ this the end of Evergrande? Here’s what may happen next, CNN, 2024

- ↑ What’s going on with China’s stock market?, MarketPlace.org

- ↑ China is facing the US financial crisis 'on steroids' as the real estate market collapses, famed hedge fund boss says, Yahoo Finance, February 6, 2023

- ↑ China real estate crash would threaten goal of doubling GDP: report, Nikkei Asia, 2023

- ↑ What’s going on with China’s stock market?, MarketPlace.org

- ↑ What’s going on with China’s stock market?, MarketPlace.org

- ↑ China rolled out a new measure of youth unemployment. It shows the nation's labor market is still a mess, think tank says

- ↑ Russia’s population is in a historic decline as emigration, war and a plunging birth rate form a ‘perfect storm’, Fortune magazine, 2022

- ↑ Russian Economy About to 'Hit the Ice,' Putin Ally Warns, Newsweek, November 23, 2023

- ↑ Can Russia’s War Chest Withstand the New Oil Cap?

- ↑ Can Russia’s War Chest Withstand the New Oil Cap?

- ↑ Russia Oil Passes Price Cap as Export Revenue Hits 2023 High, Bloomberg News, August 11, 2023

- ↑ Russia Oil Passes Price Cap as Export Revenue Hits 2023 High, Bloomberg News, August 11, 2023

- ↑ Trump has Putin ‘over a barrel’ with aggressive energy policy, defense of the West, CNBC, 2017

- ↑ Resilient, stable, sustainable: The benefits of economic diversification, Booz & Company, 2011

- ↑ US Oil Production Hits Records

- ↑ Donald Trump promises to drill for oil, close southern border on first day as president

- ↑ The Oil And Gas Workers’ Association Endorses Trump For 2024 Vote

- ↑ What is the meaning of multipolar?

- ↑ Trump to West Point grads: 'We are ending the era of endless wars', Reuters, June 13, 2022

- ↑ Trump to West Point grads: 'We are ending the era of endless wars', Reuters, June 13, 2022

- ↑ Should You Be Bullish on America?

- ↑ Labor Productivity: What It Is, How to Calculate & Improve It, Investopedia

- ↑ 25 Most Productive Countries Per Capita, Yahoo Finance

- ↑ Most Productive Countries 2024

- ↑ Countries With The Most Diverse Economies

- ↑ The West needs to prepare for ‘ugly’ Russian victory in Ukraine, which will reward China, leading US political scientist warns, South China Morning Post

- ↑ Why John Mearsheimer Blames the U.S. for the Crisis in Ukraine, The New Yorker, March 2022

- ↑ Global Soft Power Index 2022: USA bounces back better to top of nation brand ranking, Brand Finance website, 2022